Stock Forecast: This Company Poised to Lead Market by 2026’s End

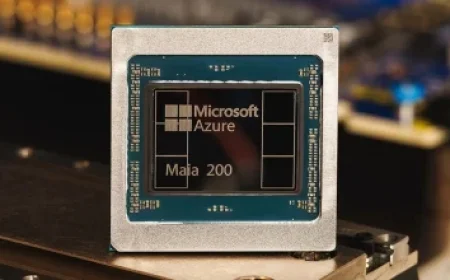

In the rapidly evolving landscape of artificial intelligence, it’s becoming starkly clear that memory is the unsung hero fueling innovation. As generative AI software, such as OpenAI’s ChatGPT, surges in capability and application, one pressing limitation looms: memory. While the hype often centers on processing power, it is the demand for memory hardware—specifically RAM and DRAM—that is shaping the industry’s future. Micron Technology is emerging as a formidable player in this arena, poised to lead a market increasingly defined by its memory needs and shortages.

Micron Technology: The Memory Market’s Rising Star

Based in Boise, Idaho, Micron has recently shifted its focus to seize a golden opportunity within the AI memory sector. With shares soaring a staggering 277% over the past year, market indicators suggest that this surge is merely the beginning. The current AI-driven memory shortage is a significant factor accelerating Micron’s growth trajectory, as highlighted by the alarming forecasts from TrendForce analyst Tom Hsu, who predicts a 50% increase in memory component prices by the first quarter of 2026.

Strategic Moves and Market Mechanics

This strategic pivot by Micron—abandoning the consumer memory market to concentrate solely on AI memory—is not just a response to current needs but a calculated play against competitors. While Nvidia garners headlines for its processing capabilities, Micron’s RAM and DRAM chips are the underpinning resources necessary for AI applications to thrive. The decision to exit consumer markets reflects a deeper strategy to focus resources on the more lucrative AI memory segment, revealing Micron’s adeptness at navigating market dynamics.

| Stakeholder | Before Micron’s Shift | After Micron’s Shift | Implications |

|---|---|---|---|

| Micron Technology | 40% focus on consumer memory market | 100% focus on AI memory market | Enhanced profit margins and revenue streams |

| Investors | Moderate growth potential | Exponential growth expectations | Increased investor confidence, reflected in share price |

| AI Companies (e.g., Nvidia) | Dependence on external memory suppliers | Increased competition for memory with Micron | Possible supplier negotiations and pricing pressures |

Micron’s financial performance reinforces its strategic direction. In Q1 of its fiscal 2026, the company reported a 57% revenue increase year over year, with DRAM sales skyrocketing by 69%. With gross and net profit margins of 45.3% and 28.15% respectively, Micron not only showcases financial health but also signals a sustained demand for its products in a market that has come to rely heavily on AI.

P/E Ratio Perspective: The Market’s Undervaluation

Despite these impressive growth figures, Micron’s forward GAAP price-to-earnings ratio of 11.6 stands nearly three-fold lower than the sector median of 31.1. This undervaluation reflects a disconnect between Micron’s actual performance and the market’s perception. The implication is clear: Micron has substantial room for growth. As Wall Street starts recognizing the importance of memory in AI infrastructure, attention will inevitably shift to Micron, boosting its visibility and valuation.

Localized Ripple Effects in Global Markets

The implications of Micron’s ascent resonate far beyond the U.S. borders, creating ripple effects across global regions. In the UK, heightened dependence on AI technology is leading to increased investments in data infrastructure. Similarly, Canadian companies are prompted to reassess their memory supply chains, while Australian tech startups are capitalizing on memory-rich AI developments to enhance their offerings. Micron’s growth story is woven into the fabric of these markets, driving collaborative advancements and competitive strategies worldwide.

Projected Outcomes: What to Watch

- Continued Revenue Growth: Analysts predict Micron’s revenue will outpace expectations as demand for DRAM across AI applications accelerates.

- Strategic Partnerships: Look for Micron to forge alliances with leading tech firms, capitalizing on shared interests in AI advancements and memory technology.

- Market Response: As data centers race to meet demand, pricing pressures may prompt a reevaluation of competitive strategies among memory providers, especially those who lag in innovation.

In summary, Micron Technology’s strategic pivot toward the AI memory market places it at the forefront of a burgeoning industry. The company’s impressive growth and market positioning suggest that it is not merely riding the AI wave but actively shaping it. As the demand for memory hardware continues to surge, Micron stands ready to fulfill the critical needs that will support the next generation of artificial intelligence.