Bitcoin Holds at $89,000 Amid Gold’s Record Surge

Gold experienced a significant surge on Wednesday, skyrocketing over 6% to surpass $5,400 per ounce for the first time. This rise solidified gold’s position as a dominant asset, boasting a market capitalization around $40 trillion. In contrast, Bitcoin, traded at approximately $89,000, demonstrated a lackluster performance.

Market Reactions to Fed Comments

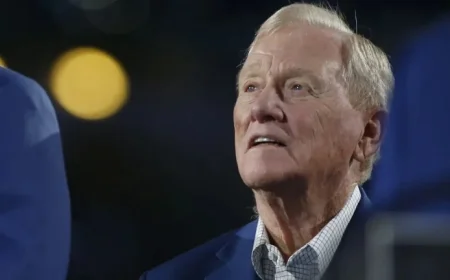

The rally in gold coincided with remarks made by Federal Reserve Chairman Jerome Powell. During a press conference, he addressed the Fed’s decision to maintain the benchmark fed funds rate at 3.50%–3.75%. Powell urged caution regarding interpretations of the gold and silver price increases, suggesting they should not be seen as a broader economic signal.

Powell’s Assertions

- Powell emphasized that inflation expectations have remained stable.

- He denied claims about the Fed losing credibility, asserting that it remained intact.

Despite Powell’s reassurances, gold investors responded positively, further boosting gold prices. Meanwhile, Bitcoin’ performance remained stagnant amid this bullish gold market.

Bitcoin’s Position in the Market

Bitcoin’s price held at $89,210.32 during the trading day, remaining flat for a 24-hour period. The overall cryptocurrency market did not show significant movement, reflecting a wider trend of underperformance relative to traditional assets like gold.

Comparing Gold and Bitcoin

While Bitcoin was often dubbed “digital gold,” its recent struggles suggest a divergence from this narrative. Gold has surged over 90% in the past year, raising questions about Bitcoin’s viability as a macro hedge.

Expert Insights

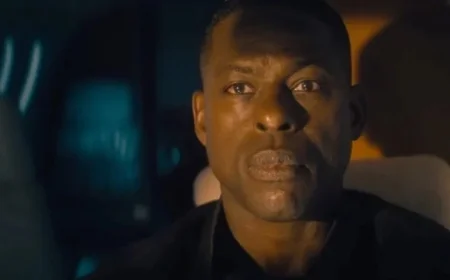

James Harris, CEO of Tesseract Group, commented on the situation, highlighting that the cryptocurrency sector appears to be lagging behind traditional assets. He noted this shift could reflect a reassessment of geopolitical and fiscal risks, indicating that gold is reclaiming some market share from Bitcoin.

Future Implications

- Investors will continue to monitor Bitcoin amidst gold’s ongoing rise.

- The competition between these assets could reshape investment strategies.

As the economic landscape evolves, the contrasting performances of gold and Bitcoin may prompt investors to rethink their portfolios. The next steps for Bitcoin remain uncertain as gold maintains its stronghold.