Early February and March Payments for Some Social Security Beneficiaries

The impending insolvency of Social Security and Medicare is a growing concern among policymakers and retirees alike. As these critical programs face significant fiscal challenges, some Social Security beneficiaries will experience a slight change in their payment schedule in February and March 2024. This situation arises due to calendar quirks that could serve to highlight deeper systemic vulnerabilities within the U.S. financial framework.

February and March Payments for Some Social Security Beneficiaries: An Overview

Under normal circumstances, Supplemental Security Income (SSI) payments are disbursed by the Social Security Administration (SSA) on the first of the month. However, when that day falls on a weekend or a federal holiday, payments are shifted to the last business day of the previous month to ensure that beneficiaries receive their funds on time. For this year, as February 1 and March 1 land on Sunday, beneficiaries will receive payments on January 30 and February 27, respectively. This adjustment not only eases immediate financial pressures for retirees but also raises questions about the long-term sustainability of the system itself.

| Stakeholder | Before the Change | After the Change | Impact Analysis |

|---|---|---|---|

| Beneficiaries | Regular payment schedule | Earlier payment dates | Temporary cash flow relief |

| Government | Ongoing payment obligations | Adjusted disbursement schedule | Increased scrutiny on funding adequacy |

| Financial Markets | Stable expectations | Potential uncertainty | Market reactions to potential cuts |

A Strategic Manipulation of Timing

This decision to adjust payment dates serves as a tactical hedge against the potential fallout of a government shutdown. With Congress in a deadlock over funding, the SSA has taken steps to minimize disruption to beneficiaries, a group already facing numerous economic pressures. The maneuver reflects a deeper tension between meeting immediate fiscal needs and the looming long-term insolvency of these critical social safety nets. As political factions bicker, it seems beneficiaries are caught in the crossfire, making these minor adjustments more than just a scheduling quirk.

Global and Localized Ripple Effects

The implications of changing SSI payment schedules reverberate beyond the individual beneficiaries in the United States. In countries like the UK, Canada, and Australia, similar concerns about social security systems’ sustainability are growing. For instance, as inflation rises globally, these nations are also faced with rising costs for maintaining public pensions and health care systems. The U.S. situation may serve as both a cautionary tale and a case study for how other nations might approach their impending reform challenges.

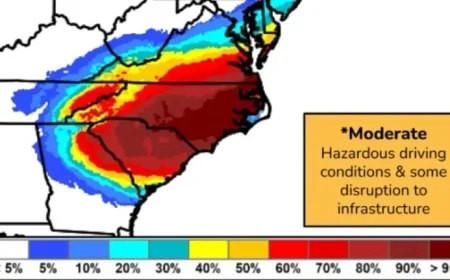

Regions across the U.S. are already feeling the effects of these financial anxieties, particularly in areas where a significant portion of the population relies on Social Security benefits. The discrepancy in timing and service delivery can create localized economic downturns as retirees adjust their spending habits, potentially stunting growth in local economies dependent on their purchasing power.

Projected Outcomes: Navigating the Future

As we navigate through these uncertain waters, several key developments warrant attention in the coming weeks:

- Legislative Actions: Watch closely for any Congressional moves to address the funding gaps in Social Security and Medicare, as these policies will shape the future of benefits.

- Public Sentiment: Increased public scrutiny and discussion around social safety nets may prompt advocates and lobbyists to ramp up their efforts, influencing policy trajectories.

- Market Reactions: Financial markets may respond to instability within these critical programs. Keep an eye on stock performance and investment patterns, particularly in sectors like health care and financial services that depend heavily on federal funding.

In summary, while earlier SSI payments may offer temporary relief to beneficiaries, they also underscore the precarious state of Social Security and Medicare. This adjustment unveils the complexities and competing interests at play within U.S. fiscal policy, as stakeholders brace for the repercussions of inaction on comprehensive reform.