Stock Market Set to Open Lower: Apple, Microsoft, Tesla Lead Movers

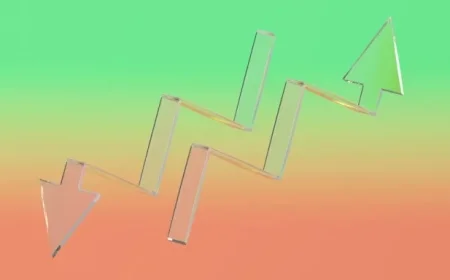

Stock market futures are poised to decline after a week marked by volatility. The announcement from President Donald Trump regarding the upcoming chairperson of the Federal Reserve is central to current market sentiments. Former Fed governor Kevin Warsh is now the leading contender for the role. Betting markets have increased Warsh’s chances of succeeding Jerome Powell to 85%, a rise from 30% just one day prior.

Market Response to Fed Chair Announcement

Investors are anticipating that whoever assumes the chair position will likely align with Trump’s agenda for reduced interest rates. Concerns about the independence of the Federal Reserve persist due to Trump’s consistent criticism of Powell, who has argued that the subpoenas issued against the central bank were politically motivated.

Potential Candidates for Fed Chair

In addition to Warsh, President Trump has interviewed three other candidates:

- Kevin Hassett – Chief White House economist

- Rick Rieder – BlackRock executive

- Christopher Waller – Current Fed governor

As futures tied to the main stock indexes trend downward, the Dow Jones Industrial Average fell by 324 points, or 0.7%, in premarket trading. The S&P 500 futures also dipped 0.7%, while the tech-heavy Nasdaq 100 saw a decline of 0.8%. This decline follows a 0.7% drop in technology stocks observed on Thursday.

Tech Stocks and Economic Indicators

Despite Apple reporting better-than-expected earnings, investor confidence remains low for major tech companies. Microsoft, in particular, experienced a 10% decrease during regular trading due to disappointing financial results earlier in the week.

Market Trends and Treasury Yields

Amid these developments, the U.S. dollar showed signs of slight strengthening. Analysts suggest that a Warsh nomination could enhance hopes for Fed independence and inject stability into the markets. In terms of U.S. Treasury yields, the two-year yield increased by 1.4 basis points to 3.564%. The 10-year yield rose by 4 basis points to 4.266%, while the 30-year yield also increased by 4.5 basis points to 4.899%, according to Tradeweb data.

On the commodities front, a significant selloff occurred in gold and silver prices, which fell by 3.5% and 7.9%, respectively. Investors had previously turned to these precious metals as safe-haven assets amid geopolitical uncertainties. UBS Global Research’s Joni Teves commented on the situation, noting that “short-term price action is becoming excessive,” indicating a rising risk of a correction. Despite this, the long-term outlook for gold remains favorable.