SoFi Achieves Record Q4 2025 Revenue, Growth, and $174M Net Income

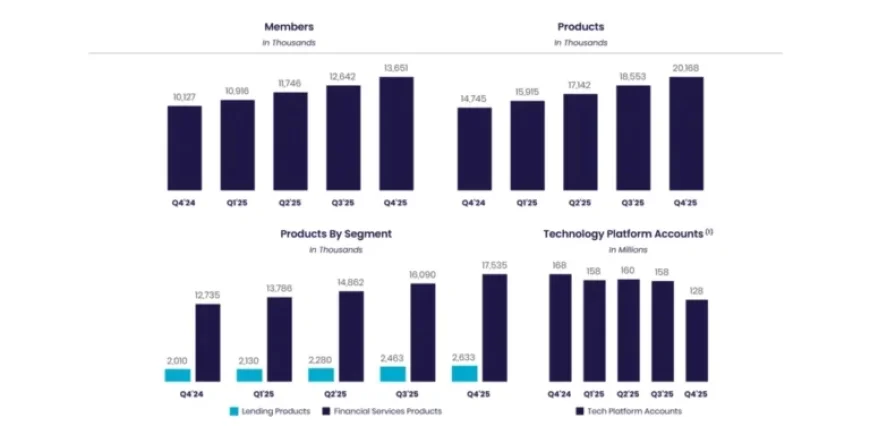

SoFi Technologies, Inc. (NASDAQ: SOFI) reported striking financial results for the fourth quarter and fiscal year ending December 31, 2025, solidifying its status as a leader in the digital financial services arena. The company achieved a remarkable quarterly revenue milestone, surpassing $1 billion for the first time in history. CEO Anthony Noto described 2025 as “a tremendous year,” attributing this milestone to the successful scaling of SoFi’s broad array of services designed to meet diverse financial needs, from borrowing to investing. The addition of a record 1 million new members in Q4 driven by innovations in crypto and blockchain positions SoFi for sustained growth and profitability in the years to come.

Breaking Down the Success: Record Figures and Strategic Insights

This growth in members and revenue highlights SoFi’s strategic focus on a member-centric model alongside technological development. The company added over 1.6 million new products in Q4 alone, indicating strong cross-buy behavior among existing members. Notably, products provided by SoFi Money, Relay, and Invest drove 89% of this growth. Such metrics are not mere numbers; they reflect savvy marketing and a genuine engagement with the financial needs of the modern consumer.

The company’s emphasis on fee-based revenue also reveals a strategic pivot. Total fee-based revenue soared to $443 million—up 50% year-over-year—particularly buoyed by the Loan Platform Business, which generated substantial returns. This diversification underscores how SoFi not only adapts but capitalizes on shifting market dynamics, providing a safety net against potential downturns in traditional revenue streams.

| Stakeholder | Before | After |

|---|---|---|

| SoFi Executives | Facing growth hurdles and uncertain market conditions | Confidence in executing growth strategies with robust revenue |

| Members | Limited access to comprehensive financial services | Expanded financial products tailored to diverse needs |

| Investors | Wary of profitability issues | Renewed belief in future stability and growth metrics |

| Market Analysts | Observing volatility in fintech sector | Spotting resilience and innovation as differentiators |

Ripple Effects Across Markets: A Global Insight

The implications of SoFi’s achievements ripple across international markets such as the US, UK, Canada, and Australia. In the US, anticipated regulatory shifts may create new opportunities for fintechs like SoFi, potentially lowering entry barriers. Meanwhile, in the UK and Canada, where digital banking is gaining traction, SoFi’s success may inspire competitors to iterate faster and innovate aggressively to capture a similar audience. Australia, with its growing youth demographic keen on digital banking solutions, could see SoFi’s offerings resonating effectively given their holistic approach to personal finance.

Projected Outcomes: What to Watch for Next

As SoFi strides into 2026, several key developments are anticipated:

- Membership Growth: SoFi aims to increase total members by at least 30% year-over-year, fueled by expanded product offerings and enhanced marketing strategies.

- Innovation in Crypto: The rollout of SoFi’s stablecoin and blockchain innovations may set new industry standards for security and user engagement in financial transactions.

- Fiscal Performance: Management projects adjusted net revenue of approximately $4.655 billion in 2026, a robust growth metric signaling operational health and strategic oversight.

The convergence of these factors positions SoFi not just as a fintech innovator but as a dominant player in reshaping the financial services landscape, setting a standard for others in the industry to follow.