Tesla Halts Car Sales Amid Market Challenges

Tesla has recently taken significant steps that raise questions about its role as a car company. The focus is shifting from traditional automotive sales to ambitious goals surrounding artificial intelligence and robotics. Tesla leaders, including Elon Musk, indicated that the company’s trajectory now centers more on innovation and technology than on selling vehicles.

Tesla’s Market Challenges and Strategic Shift

During a quarterly earnings call, Musk announced that Tesla would discontinue its iconic Model S and Model X electric vehicles (EVs). This decision reflects a broader strategy to prioritize the development of autonomous technologies, particularly humanoid robots, even though the latter has faced notable challenges.

Redefining Tesla’s Business Model

Musk emphasized that Tesla should be perceived more as a provider of “transportation as a service.” He projected that the majority of future travel would involve autonomous vehicles, diminishing the need for personal vehicle ownership. Musk stated, “The vast majority of miles traveled will be autonomous in the future.”

Despite these shifts, Tesla still relies heavily on automotive sales, which accounted for 73% of its $94.8 billion revenue in 2025. However, automotive sales have decreased by 10% year over year, leading Tesla to lose its position as the leading EV manufacturer globally, falling behind BYD.

Subscription Model and Future Revenue

The company is now exploring subscription services as a major revenue source. Recently, it reported 1.1 million active subscriptions for its Full Self-Driving (FSD) feature, showing a 38% increase from late 2024. Going forward, Tesla plans to offer FSD solely through subscriptions, rather than standalone purchases.

- FSD allows hands-free driving but requires driver attention.

- Tesla has faced legal scrutiny over the safety and marketing of FSD.

Investment in Autonomous Technologies

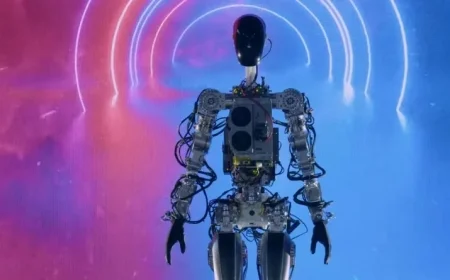

Looking to the future, Musk has ambitious plans for Tesla’s autonomous taxi services and a new iteration of its Optimus robot, aiming for mass production by 2027. This pivot is part of Musk’s broader vision, which includes a personal financial goal linked to a substantial pay package tied to Tesla’s performance in AI and robotics.

Financial Outlook and Future Costs

Musk revealed that Tesla would invest approximately $20 billion in capital expenditures by 2026. This marks a significant increase from the previous year’s expenditures and will focus on developing production lines for various initiatives, including a fully autonomous vehicle called Cybercab.

Despite these ambitious plans, financial analysts express skepticism about Tesla’s ability to sustain its current revenue model solely through subscriptions. The discontinuation of the Model S and Model X has further reduced the vehicle lineup, pushing the company into an uncertain financial future.

Overall, while Tesla’s vision for the future leans heavily into robotics and autonomous driving, the company must grapple with the challenges of transitioning away from traditional car sales. The question remains whether Tesla can effectively redefine its identity and maintain profitability in a rapidly evolving market.