Gold, Silver Dive as Traders React to Trump’s Fed Chief Selection

The precious metals market experienced a significant downturn as traders reacted to the recent appointment of Kevin Warsh as Federal Reserve Chair. This announcement, made by former President Donald Trump, sent shockwaves through the trading community, resulting in dramatic declines for gold and silver prices.

Gold and Silver Prices Plummet

On Friday, gold saw a striking decrease of 12%, bringing its price to approximately $4,786 per ounce. Despite this drop, gold has still appreciated by about 65% within the past year. The decline on Friday marked the most severe single-day loss for gold in over a decade.

Silver faced an even steeper decline, plunging as much as 32% to around $80 an ounce. This drop represents the most significant loss for silver since 1980. The entire precious metals market reacted sharply as investors adjusted their expectations for future monetary policy.

Market Reaction to Fed Chair Selection

Warsh’s potential confirmation could signify a shift in the Federal Reserve’s approach. As a former Fed Governor, he is perceived as more hawkish compared to Jerome Powell.

Investors had anticipated a more dovish stance, favoring lower interest rates, which typically increase demand for gold and silver. The announcement triggered a sell-off in precious metals, as fears over changes in monetary policy dampened the previous enthusiasm driven by the debasement trade.

Impact on the Stock Market

The selection of Warsh affected U.S. stock markets as well. The tech-heavy Nasdaq Composite fell over 1%, while the S&P 500 continued its retreat from the critical 7,000 mark it initially surpassed earlier in the week.

Dollar Index Movement

The U.S. Dollar Index, which has been down about 11% over the past year, saw an uptick of nearly 1% following the announcement. This immediate increase in the dollar value contributed to the metals sell-off, highlighting a correlation between currency strength and precious metal prices.

Expert Insights

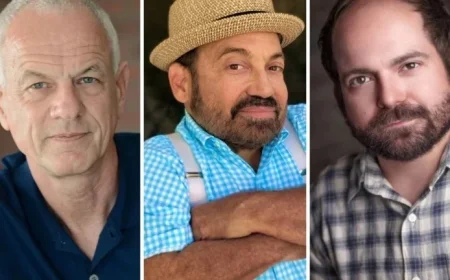

- Art Hogan, Chief Market Strategist at B. Riley Wealth Management, noted that such a technical pullback was expected after a parabolic rise in metals.

- José Torres, Senior Economist at Interactive Brokers, characterized the sell-off as a “knee-jerk reaction” to Warsh’s nomination.

- David Rosenberg of Rosenberg Research indicated that investors might begin reversing their positions on the debasement trade due to Warsh’s conventional approach.

The response from the market illustrates the uncertainty surrounding the Federal Reserve’s future strategies and its potential impact on inflation and interest rates. As markets continue to react to these developments, volatility in precious metals is likely to persist.