Gold price today tumbles after record run, with traders watching $5,000 pivot

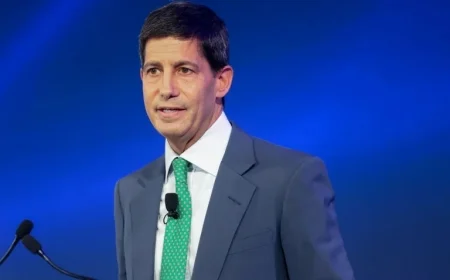

Gold price today slid violently on Friday, Jan. 30, 2026, snapping a record-setting rally and delivering one of the sharpest daily selloffs in decades. The move followed Thursday’s fresh all-time high and unfolded as the U.S. dollar strengthened and investors rapidly reduced crowded “long gold” positions after President Donald Trump confirmed Kevin Warsh as his pick to lead the Federal Reserve when Jerome Powell’s chair term ends in May.

By the end of the U.S. session, gold was still historically elevated—but the day’s whipsaw reset the market from a momentum surge into a high-volatility, two-way battle where key support levels matter more than bold new highs.

Gold price today: where it finished

Friday’s action was defined by an extreme intraday range and a late attempt to stabilize off the lows. Spot pricing varies by feed and timestamp, but the closing picture was consistent: a steep drop from Thursday’s peak.

| Benchmark (USD) | Level | Notes |

|---|---|---|

| Spot gold close (XAU/USD) | ~4,892/oz | Friday close reference |

| Spot gold day low / day high | ~4,682 / ~5,451 | Wide intraday range |

| COMEX gold futures (nearby) settle | ~4,745/oz | Futures fell harder than spot |

| GLD (SPDR Gold Shares) close | 444.95 | Down ~10.2% vs prior close |

What triggered the reversal

Two forces hit at once.

First, the Fed leadership headline changed the tone of rate expectations. A new chair nominee matters because markets price the future path of policy—how quickly rates could fall, how tight financial conditions may remain, and how aggressively the Fed manages its balance sheet. Even before any confirmation vote, that shift can ripple into the dollar and yields.

Second, gold entered Friday stretched. January’s surge pulled in leverage and momentum strategies; once the trade turned, the unwind became self-reinforcing. Profit-taking, stop-loss triggers, and risk limits can all activate quickly in futures and options, amplifying intraday swings and widening the gap between spot and futures during the most disorderly moments.

Why the $5,000 level is now the market’s anchor

After a parabolic month, round numbers start acting like magnets. $5,000 has become a psychological “line in the sand” because it’s both a headline milestone and a common reference point for options strikes and trading systems.

Friday’s brief break below that area mattered less as a single tick and more as a signal: liquidity thinned, selling accelerated, then buyers stepped in once the market looked over-extended to the downside. The next several sessions will test whether $5,000 becomes a base that attracts demand—or a ceiling that caps rebounds while the market digests excess positioning.

In practical terms, traders are watching:

-

repeated failures or holds around $5,000,

-

whether volatility compresses (a sign forced selling is ending),

-

and whether spot-futures pricing normalizes as liquidity improves.

GLD stock mirrors bullion, but with equity-market pressure

GLD stock, a popular proxy for gold prices in brokerage accounts, fell sharply alongside the metal. Unlike spot gold, GLD also trades within the equity-market ecosystem, so broad risk-off flows can intensify moves—especially on days when stocks are also under pressure.

Friday’s decline left GLD down about 10% on the day, a scale that’s unusual for the ETF and underscores how violent the underlying metal move was. For investors who use GLD for long-term exposure, the key is not the single-day drop but whether the market stabilizes into a range where liquidity and spreads tighten back toward normal.

Gold price predictions: three scenarios after the shock

Forecasting after a day like Friday works best in scenarios tied to observable drivers:

1) Supported but choppy (high-volatility range).

Gold remains elevated if investor demand stays strong and macro uncertainty persists, but prices move in wide ranges as the market rebuilds positioning more cautiously. This scenario fits periods when rate-cut expectations fluctuate and the dollar trades in bursts rather than trends.

2) Renewed upside (risk intensifies or cuts accelerate).

Gold can re-accelerate if real yields fall meaningfully, the dollar weakens, or risk sentiment deteriorates enough to drive sustained safe-haven allocation. In this lane, the rally resumes—but likely with bigger pullbacks than the smooth climb seen earlier in January.

3) Cooling later in 2026 (risk premium fades).

Gold could drift lower over time if key macro and geopolitical supports soften, the dollar stays firm, and real yields stabilize higher. This path doesn’t require “bad news” for gold—just the removal of the urgency that helped push prices vertically.

What to watch next week

After an extreme reversal, the next drivers are straightforward:

-

the dollar’s direction,

-

real yields and rate-cut pricing,

-

ETF flows (including GLD),

-

and whether spot gold can consistently trade back above $5,000 without immediate sell pressure.

Friday’s move didn’t erase the reasons gold rose—it changed the market’s posture. The easy part of the rally is over; the next phase is about whether buyers have the conviction to defend key levels once the momentum trade has been shaken out.

Sources consulted: CME Group; Investing.com; Barchart; Yahoo Finance; Trading Economics; Federal Reserve.