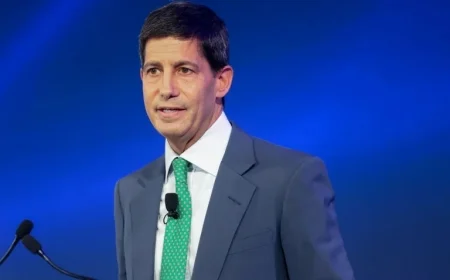

Trump Selects Inflation Hawk Kevin Warsh to Replace Fed Chair Powell

In a highly anticipated move, President Donald Trump has nominated Kevin Warsh to succeed Jerome Powell as the chair of the Federal Reserve, a position that holds significant weight in shaping U.S. monetary policy. Trump’s announcement came via his social media platform, where he expressed confidence in Warsh’s capabilities, calling him “the most qualified” candidate and predicting he would be remembered as one of the best Fed chairmen. However, this decision extends beyond mere qualifications; it reflects Trump’s ongoing struggle with inflation and his desire to exert influence over a central bank he perceives as not aligning with his administration’s economic goals.

Warsh’s Nomination: A Tactical Hedge Against Economic Scrutiny

Warsh, who once served as a Federal Reserve governor and was known as an inflation hawk, has publicly shifted his stance to favor lower interest rates, aligning himself with Trump’s urgent desire to reduce borrowing costs. This transformation may serve as a tactical hedge for Warsh, allowing him to balance previous policy criticisms while navigating the political pressure from an administration determined to mitigate the rising cost of living.

Navigating the Political Landscape: Risks of Nomination Amid Fed Independence Concerns

Trump’s selection of Warsh is laden with implications for the Federal Reserve’s independence. Recent investigations by the Trump administration, targeting Powell and other Fed officials, cast a long shadow over the potential for a smooth confirmation process. Senate Banking Committee members may use this opportunity to probe Warsh about his loyalty to the President versus his commitment to the Fed’s core mandate.

| Stakeholder | Before Warsh’s Nomination | After Warsh’s Nomination |

|---|---|---|

| Trump Administration | Frustrated with Powell’s policies, seeking lower interest rates | Potential ally in Warsh, but faces Senate resistance |

| Federal Reserve | Operating independently under Powell | Growing concerns over independence due to political pressure |

| Economists | Mixed opinions on Fed policies and inflation risks | Warsh viewed as unpredictable due to shifting policy perspectives |

| U.S. Public | Experiencing rising costs and inflation concerns | Hope for favorable monetary policies, but uncertain outcomes |

Local and Global Ripple Effects

The implications of Warsh’s nomination extend beyond U.S. borders. In markets across the UK, Canada, and Australia, policymakers watch closely as economic stability remains a global concern amid inflation fears. An influx of investor confidence could be possible if Warsh successfully manages monetary policy aligned with Trump’s ambitious economic vision. However, hesitation from Senate members over issues of Fed independence may act as a barrier, impacting international trade and foreign investment perceptions.

Projected Outcomes: What to Watch in the Coming Weeks

As the Senate Banking Committee prepares to review Warsh’s nomination, several developments are anticipated:

- Scrutiny of Warsh’s Policy Shifts: Expect tough questioning regarding his previous positions on interest rates and potential pledges made to Trump.

- Impact of Ongoing Investigations: The resolution of Trump’s investigations into Fed officials, particularly Powell, will be pivotal in determining the fate of Warsh’s nomination.

- Reactions from Financial Markets: Markets will closely monitor interest rate expectations and any signals from Warsh that could influence investor sentiment.

In essence, Warsh’s nomination not only reflects Trump’s need for an ally at the Fed but also underscores a more profound tension surrounding the institution’s autonomy. As the nomination process unfolds, stakeholders both in the U.S. and globally will watch closely, with implications that may resonate far beyond American shores.