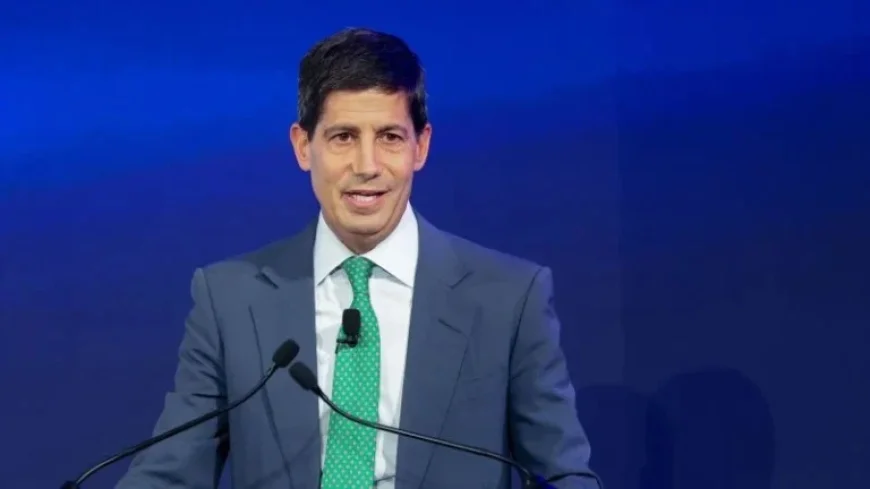

Trump Chooses Kevin Warsh to Succeed Jerome Powell at Federal Reserve

Stocks tumbled Friday afternoon as Wall Street digested President Donald Trump’s choice of Kevin Warsh to lead the Federal Reserve. The Dow Jones Industrial Average fell 245 points, or 0.5%, while the broader S&P 500 also dropped 0.5%, and the tech-heavy Nasdaq Composite slid 0.9%. If confirmed, Warsh will take the reins from Jerome Powell when his term expires in May, setting the stage for a seismic shift in monetary policy. This move serves as a tactical hedge against the prevailing uncertainties, as investors attempt to recalibrate their expectations in the face of potential policy changes driven by Warsh’s leadership.

Market Reactions and Investor Sentiments

The short-term outlook for the markets remains largely unchanged, according to Ajay Rajadhyaksha, global chairman of research at Barclays. He stated, “Markets will absorb this announcement and move on after a knee-jerk reaction.” His assertion highlights that broader tech earnings and pertinent economic data are anticipated to take precedence over Warsh’s confirmation status. Such sentiment suggests that despite the initial downturn, the market is poised for recovery as it refocuses on the fundamentals that ultimately drive investor confidence.

Warsh’s Confirmation Hearings: What Lies Ahead?

Warsh’s upcoming confirmation hearings will be pivotal in revealing his policy priorities. Brian Levitt, chief global market strategist at Invesco, emphasized the significance of these hearings, suggesting that they will shed light on how Warsh’s approach could diverge from Powell’s. Analysts are observing closely whether Warsh will maintain the Fed’s independence amid possible pressures from the Trump administration, a factor that could significantly influence investor anxieties.

| Stakeholder | Before Warsh’s Appointment | After Warsh’s Confirmation |

|---|---|---|

| Investors | Wary of rising interest rates and inflation | Increased focus on Fed’s policy direction and balance sheet |

| Big Tech Companies | Concerned over regulatory scrutiny and rate hikes | Awaiting clearer direction on interest rates and monetary policy |

| The Federal Reserve | Under Powell’s cautious leadership | Potentially more aggressive stance affecting balancing act with Treasury |

| Market Analysts | Predicting steady trends | Adapting to new signals from potential changes in Fed’s strategy |

The Global Ripple Effect of Warsh’s Potential Leadership

Beyond the confines of the U.S. market, the appointment of Kevin Warsh carries implications for global investors. In the UK, where financial institutions are grappling with economic recovery post-Brexit, any shift in U.S. Fed policies could influence currency valuations and cross-border investment strategies. Similarly, in Canada, commodity-dependent markets may react to changes in U.S. interest rates that can affect the value of the Canadian dollar. Australia stands at the forefront of these potential shifts, with its resource-heavy economy reliant on U.S. monetary policy for trade stability. Each region will be keenly observing whether Warsh’s tenure signals a return to standard interventions or a more aggressive approach in managing inflation and rates.

Projected Outcomes

As we anticipate Warsh’s confirmation, several key developments are likely to emerge:

- Market Volatility: Initial reactions to his confirmation could ignite short-term fluctuations as investors recalibrate their portfolios.

- Policy Directions: Warsh’s inclination towards reducing the Fed’s balance sheet may generate discussions around new monetary strategies that could reshape market landscapes.

- Inter-agency Dynamics: A closer relationship between the Fed and Treasury Department under Warsh may initiate a more cohesive macroeconomic policy framework, influencing how both agencies navigate future financial crises.

As these elements unfold, the markets will look to align themselves with the Fed’s strategic decisions and their broader impacts on local and global economies.