Wholesale Prices Surge Beyond Expectations

U.S. wholesale prices experienced a significant surge, rising by 0.5% in December 2024, exceeding economists’ expectations. This increase was reported by the Labor Department, who noted it was the fastest growth in three months and surpassing the anticipated 0.3% increase.

Key Economic Indicators

The Producer Price Index (PPI) highlighted a year-on-year increase of 3% in wholesale prices, aligning with forecasts. The report delivers insights into inflation trends before reaching consumers, particularly focusing on various sectors.

- Services Sector: Prices in this area rose by 0.7% from November, marking the largest increase since July. This uptick is attributed to improved profit margins among wholesalers and retailers.

- Goods Prices: Contrarily, the prices of goods, including appliances and vehicles, remained unchanged in December, although they rose by 2.5% year-over-year.

Inflation Context

Concerns over inflation due to President Trump’s tariffs on imports have been somewhat addressed. The anticipated inflationary effects have not materialized as severely as expected, yet inflation remains above the Federal Reserve’s target of 2%.

The producer price report was delayed by a 43-day federal government shutdown, but its release is crucial for predicting potential consumer inflation trends. Economists closely monitor PPI as specific components feed into the Federal Reserve’s preferred measure of inflation, the Personal Consumption Expenditures (PCE) Price Index.

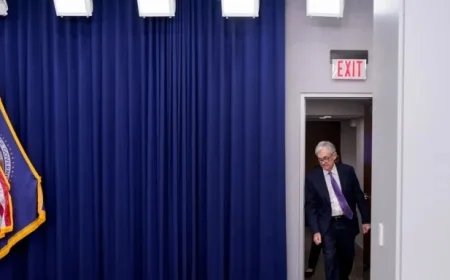

Implications for Monetary Policy

Recent figures support the Federal Reserve’s decision to maintain its key interest rate at a steady level. With consumer inflation poised for an uptick, it is likely that the Federal Reserve will sustain this rate for the coming months.

Upcoming Reports

The Labor Department is set to release a more comprehensive Consumer Price Index (CPI) report on January 13. Early indications suggest a slight easing of inflationary pressures in December, driven by declines in gas and used car prices.

This emerging data is essential, as it shapes monetary policy and economic planning across various sectors, indicating potential adjustments to interest rates in the future.