NS&I Considers Cutting Legacy Links to Fix IT Issues

The National Savings & Investment (NS&I) agency in the UK is reassessing its modernization strategy. The agency faces significant schedule delays and budget overruns. The current transformation project has exceeded its budget by £1.3 billion and is four years behind schedule.

Background of NS&I’s Transformation

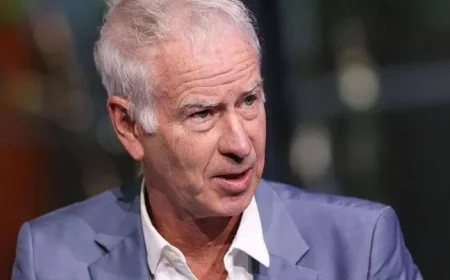

In December, NS&I chief executive Dax Harkins communicated with Members of Parliament (MPs) regarding the program’s status. He indicated that the modernization plan, developed in collaboration with Capgemini, is not on track to meet its new target date of March 2028.

Financial Challenges

- £1.3 billion budget overrun.

- Four years delayed.

- New spending plan revised without approval from HM Treasury.

This transformation aims to upgrade both customer technology and the banking engine. However, it carries significant risks, as highlighted by the National Audit Office (NAO).

Streamlining Legacy Systems

In response to these challenges, NS&I is considering reducing connections to its older legacy systems. Harkins stated that a reevaluation of existing resources and technologies is essential. The agency is exploring various options to enhance program delivery within the set budget.

Next Steps

Work is already in progress to evaluate the potential risks and benefits of each proposed option. This analysis will inform decisions moving forward. A draft business case will be produced for the preferred option, with final approvals required from government ministers.

Impact of Contractual Agreements

NS&I’s modernization involves multiple contracts, particularly with Atos, which handles legacy systems. Initially, NS&I aimed to launch competitive bidding for new banking and reporting systems. However, they ultimately awarded the contract to Atos due to its existing relationship with the agency.

Projected Costs

- Total expected cost of the program: £3 billion by 2030-31.

- Cost increase from the initial 2020 business case: £1.3 billion.

Moving forward, NS&I aims to complete its options analysis by March 2026, seeking approval for plans from HM Treasury by June 2026.