Banks and Credit Unions Approach Major Open Finance Transformation

As the landscape of banking evolves, the adoption of open finance is no longer a distant goal but an urgent tactical imperative for banks and credit unions. The latest insights from El-Balad’s analytical coverage of the American Banker’s 2026 State of Open Finance Adoption Report reveal that financial institutions are caught in a dual bind: the desire to innovate through open finance initiatives clashes with regulatory apprehensions and technological challenges. The critical role of application programming interfaces (APIs) as a catalyst for this transformation cannot be overstated.

Banks and Credit Unions Approach Major Open Finance Transformation

The survey, conducted among 218 banking professionals in October 2025, unearthed notable insights into the current state of open finance adoption. Most respondents indicated that their institutions remain firmly entrenched in planning phases, assessing market trends and regulatory landscapes. Specifically, 59% of credit union executives and 33% of community bankers are actively evaluating these dynamics. With the Consumer Financial Protection Bureau’s (CFPB) interim 1033 rule stirring uncertainty, many executives find themselves at a crossroads, hesitant to fully commit resources.

The Planning Phase: Opportunities and Obstacles

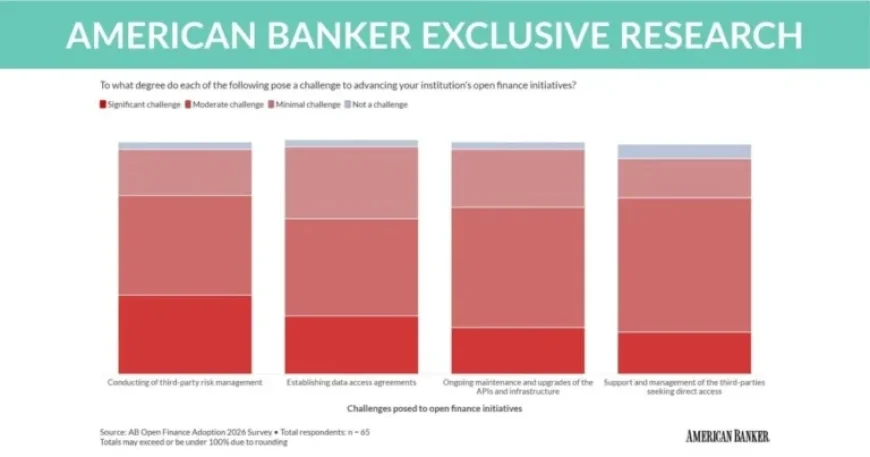

The path towards open finance is littered with hurdles. A substantial 34% of respondents highlighted third-party risk management as the primary obstacle to their institutions exploring open finance programs. This reveals a deeper concern about the vulnerabilities introduced by increased data sharing. Organizations face an uphill battle in developing robust risk management frameworks, particularly as cyber threats loom menacingly. Chris Miller of Cornerstone Advisors summarizes this sentiment, noting the regulatory landscape’s volatility and its potential to deter smaller players from meaningful innovation.

| Stakeholder | Situation Before | Situation After | Impact of Open Finance |

|---|---|---|---|

| Community Bankers | In planning phase (33%) | Some exploring API implementation (25%) | Increased vulnerability due to reliance on mixed data access methods |

| Regional Bankers | Developing strategies (32%) | Concerns over compliance with regulatory changes | Enhanced competitiveness through partnerships with fintechs |

| National Bankers | Very few (5%) integrated open finance | Allowed a quarter to use APIs for data sharing | Need for robust support structures to mitigate risks |

| Credit Unions | Majority assessing (59%) | Very few fully utilizing APIs (0%) | Potential to capitalize on untapped market opportunities |

While many institutions are caught in this ambiguous stage of assessment, some have begun to develop strategies, with 32% of regional bankers and 14% of credit union leaders actively seeking to define their objectives and business cases. However, the pressing need for regulatory clarity looms large, creating a cautious atmosphere stifling more robust integration of open finance products.

API Adoption and Risk Management

The shift from screen scraping methods to API-driven data sharing highlights a paradigm shift in how financial institutions engage with open finance. Approximately a quarter of banking respondents confirm their institutions allow third-party access exclusively through APIs. This reflects a cautious but necessary pivot toward enhanced security measures, with larger institutions recognizing the imperative to treat their APIs as critical products rather than mere technical conduits.

Nevertheless, a staggering 58% of respondents acknowledged that oversight and support for third-party firms create significant challenges. As cybersecurity threats escalate, the reliance on external partners to ensure data integrity becomes a double-edged sword. Financial institutions must navigate a delicate balance between innovation and risk mitigation, especially as data breaches become increasingly prominent in headlines.

Market Uncertainty and Future Implications

Despite these challenges, a sizable 72% of respondents perceive open finance as a strategic growth opportunity. This reflects a broader industry trend where banks aim to leverage fintech partnerships to strengthen their market positions. However, they must address internal preparedness first; while 70% of respondents consider their technology infrastructure sufficient for engaging in open finance, a significant 16% feel unprepared.

Looking forward, the upcoming weeks will be pivotal for banks and credit unions as they tackle these challenges head-on. The anticipation surrounding the CFPB’s regulatory guidance remains a critical variable, potentially reshaping the landscape of open finance.

Projected Outcomes: What to Watch

- Regulatory Developments: Watch for the CFPB’s final rulings on the interim 1033 rule, which could expedite or hinder open finance expansion, particularly for community and regional banks.

- Technological Partnerships: Expect a rise in collaborations between traditional banks and fintech firms, aimed at streamlining APIs and enhancing overall data integrity.

- Increased Consumer Expectations: As open finance transforms consumer experiences, financial institutions will be compelled to innovate at an accelerated pace to meet heightened expectations for seamless financial solutions.

As financial entities navigate these waters, the true measure of success will not only be in adopting open finance solutions but in doing so while safeguarding consumer interests and maintaining robust security frameworks. The road ahead for banks and credit unions is fraught with challenges, yet the potential rewards of embracing open finance are too substantial to ignore.