Common Social Security Questions Answered with Clarity

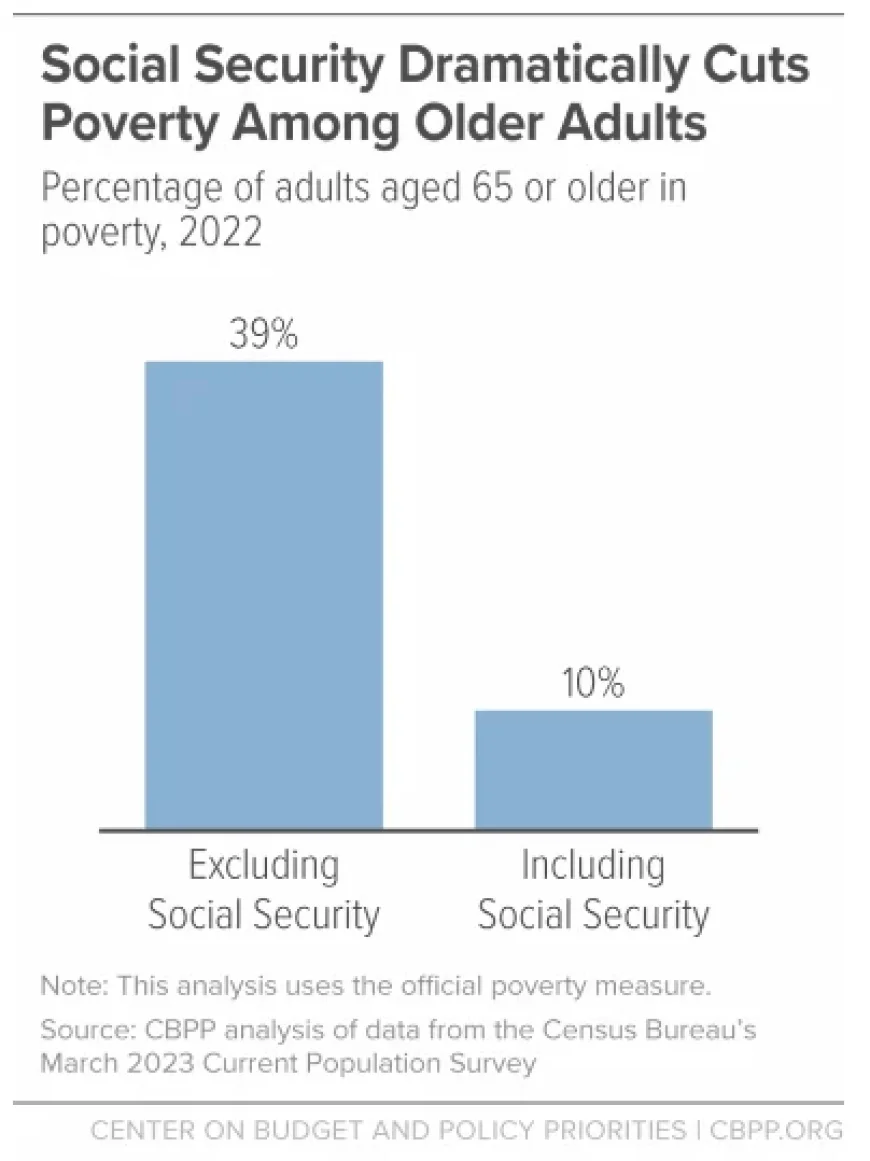

Social Security serves as a vital retirement safety net for millions of Americans. Currently, around 70 million people are receiving benefits. This number is expected to increase as the baby boomer generation continues to retire. For those aged 65 and older, over 40% depend on Social Security for at least half of their income. Many retirees could face significant financial challenges without these benefits.

Common Social Security Questions Answered with Clarity

As concerns about the future of Social Security grow, several questions remain prevalent.

Is Social Security Going Insolvent?

Recent reports from the Social Security Administration indicate that the trust fund will begin paying out more than it collects by 2034. This program relies on current tax income, and with an increasing number of retirees, the worker-to-beneficiary ratio is projected to decline from 2.7 to 2.3 by 2035. While this may stress the system, the actuarial assessments still forecast that benefits will cover approximately 80% of obligations in the mid-2030s, indicating that while changes are necessary, the crisis is manageable.

Will Young People Receive Benefits?

Despite financial challenges, projections show that Social Security taxes could fund around 70% of benefits by 2099. Thus, younger generations can still anticipate receiving some assistance from the program.

How Can We Address the Funding Gap?

Addressing the potential shortfall depends largely on political actions. Lawmakers could consider various strategies, such as:

- Diverting funds from other government spending.

- Increasing the federal debt.

- Raising the retirement age for younger workers.

- Raising the income cap subject to Social Security taxes.

These measures represent potential solutions to extend the life of the Social Security program.

What If Benefits Are Cut?

If no agreement is reached by the 2030s, benefits might be reduced to about 80% of their intent. However, cutting benefits is politically risky, as overwhelming support exists for Social Security across party lines, with a recent AARP survey showing 95% of Republicans, 98% of Democrats, and 93% of independents in favor of maintaining the program.

The Future Outlook

While uncertainties regarding Social Security’s future remain, it is unlikely to become an immediate concern for current retirees. The focus will be on individual decisions regarding when to claim benefits, which can significantly impact retirement income.

For more personalized insights, resources like the free Social Security calculator from Open Social Security can be invaluable tools for planning. Additionally, various podcasts and expert discussions provide further clarity on this essential topic.