CME Gap Up Offers BTC Bulls Hope – CoinDesk

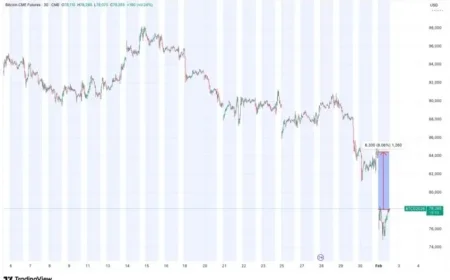

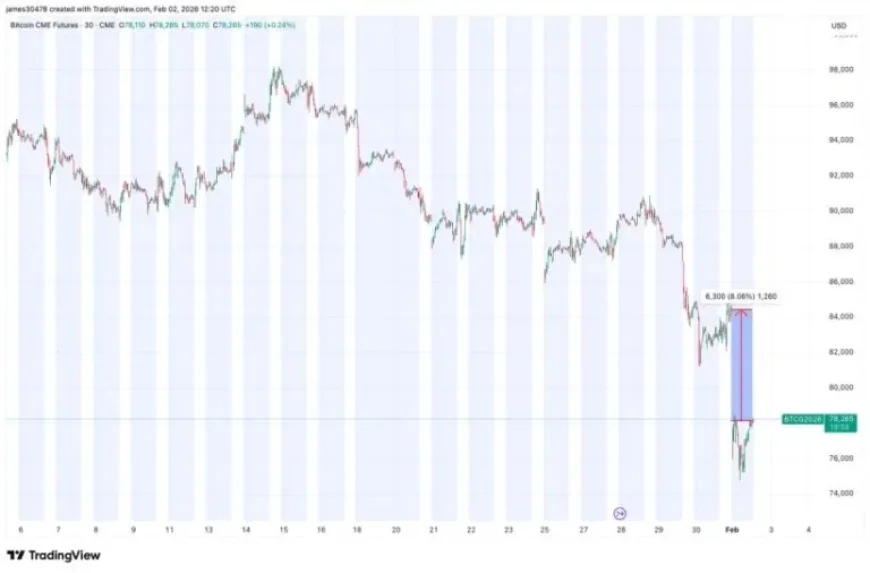

After enduring a challenging week, Bitcoin (BTC) investors are finding renewed hope due to a gap up in the Chicago Mercantile Exchange (CME) futures market. This gap indicates potential upward momentum that could benefit BTC bulls in the near future.

CME Gap Analysis

The CME gap occurs when there is a significant difference between the close of Bitcoin futures on Friday and the opening price on Sunday. This gap often serves as a psychological indicator for traders.

Market Overview

- Bitcoin recently hit a ten-month low, dropping below the $75,000 mark.

- Ethereum (ETH) also experienced a decline during the same period.

- Various factors are contributing to the current bearish sentiment in the cryptocurrency market.

Factors Influencing Bitcoin’s Downtrend

- Increased market volatility.

- Negative macroeconomic signals impacting investor confidence.

- Ongoing regulatory concerns affecting the broader crypto landscape.

Despite these challenges, the CME gap offers a glimmer of hope for those bullish on BTC. Technical analysts often look to fill these gaps as a part of market behavior analysis. Historical patterns suggest that filling a gap may result in recovery and potential gains.

Looking Ahead

As investors monitor the evolving market conditions, eyes will remain on Bitcoin’s price action in relation to the CME gap. A successful breakout above current resistance levels could signal a shift in sentiment, providing Bitcoin bulls with the momentum they seek.