Dollar Fluctuations: What’s Driving the Changes?

In recent years, fluctuations in the value of the U.S. dollar have become a key topic among investors and economists. These changes have far-reaching implications for stocks, bonds, and various commodities. The year 2025 marked a significant shift in market dynamics, where international stocks significantly outperformed U.S. equities, largely influenced by the declining dollar.

Dollar Fluctuations and Market Impact

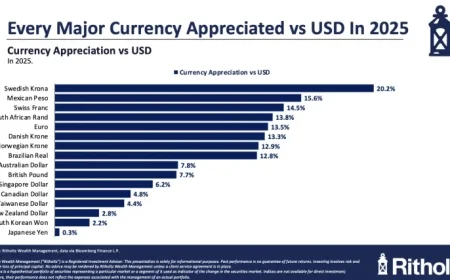

The U.S. dollar weakened by approximately 9.2% in 2025, making it the most significant drop since 2017. Over the past year, international stocks gained over 33%, approximately double the increase seen in the U.S. market. This trend indicated a shift in global investment patterns, as international currencies have shown remarkable resilience against the U.S. dollar.

Reasons Behind the Dollar’s Decline

- The weakening dollar has led to increased repatriation of capital by overseas investors.

- Major trading partners expressed dissatisfaction with U.S. tariffs and defense policies.

- This dissatisfaction prompted foreign investors to reduce their exposure to U.S.-based assets.

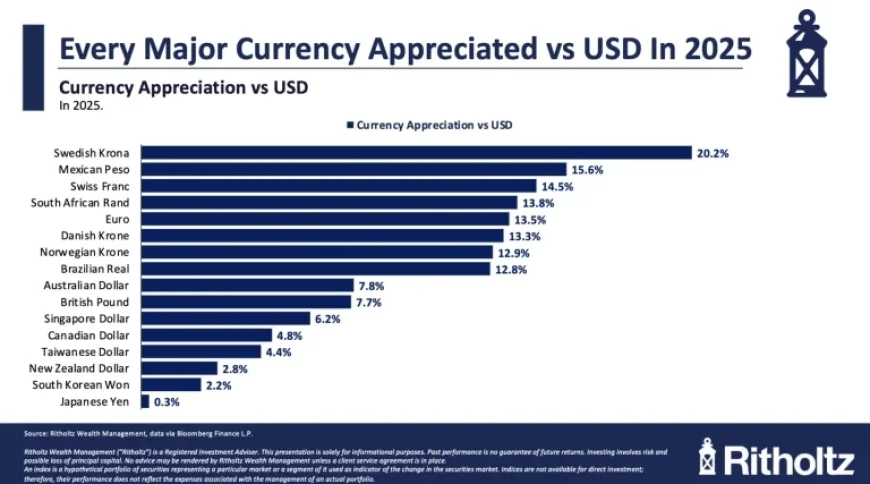

In 2025, every major currency appreciated against the U.S. dollar, underscoring the growing trend of investors converting U.S. dollars to their local currencies. This situation suggests a broader movement among investors to minimize risk associated with U.S. assets.

The Global Economic Context

The interconnected nature of today’s global economy means that trading partners are not solely reliant on the U.S. market. While the U.S. has historically led global economic growth, foreign investors are exploring local opportunities. The phenomenon, often referred to as a “Repatriation Trade,” highlights how dissatisfied partners can effectively vote with their capital.

The appreciation of currencies such as the euro, pound, yen, and others against the U.S. dollar signals a collective response from global investors. This has significant implications for future U.S. economic policies and their impact on international relations.

Future of the Dollar as a Reserve Currency

Despite current fluctuations, experts do not predict an end to the dollar’s status as the global reserve currency. However, the ongoing trend warrants careful observation. If U.S. policies do not evolve, the potential for further capital flight could become a reality. Investors are keenly aware that adverse diplomatic relations can have immediate financial repercussions.

As the market landscape continues to shift, it remains critical for stakeholders to pay attention to these dynamics. Policymaking that considers the interests of trading partners may help stabilize the dollar and foster better economic relationships. Addressing the concerns over tariffs and trade can create a more favorable investment environment, ultimately benefiting both the U.S. economy and its global partners.