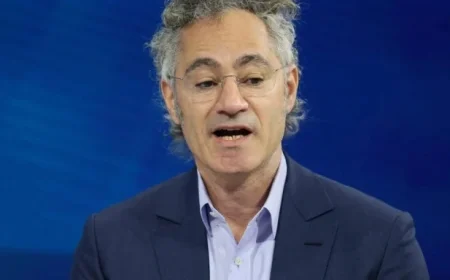

Stephen Miran Resigns from White House, Retains Federal Reserve Position

Stephen Miran has resigned from his leadership position at the White House’s Council of Economic Advisers while maintaining his role as a Federal Reserve Governor. This departure was confirmed in a letter obtained by news sources and marks a significant shift in the Trump administration’s economic strategy.

Details of Stephen Miran’s Resignation

Miran’s resignation was officially communicated in a letter dated Tuesday. He indicated that he had promised senators he would step down from the White House if he continued at the Fed past January. His move comes as part of a unique arrangement where he previously held both roles through unpaid leave.

Background and Implications

His term as a Federal Reserve Governor is set against a backdrop of significant changes proposed by President Trump. His term officially expired on January 31, fulfilling the remaining months left by another governor who had resigned.

Impact on Federal Reserve Leadership

- The resignation creates openings that may facilitate Trump’s nomination of Kevin Warsh as the new Fed chair.

- Jerome Powell’s term will conclude in May, and only a sitting Fed governor can ascend to the chair position.

- Miran’s exit potentially allows the administration to maneuver Warsh into leadership before Powell’s exit, shaping future interest-rate policies.

This move underscores the intensifying scrutiny Trump has placed on the Federal Reserve. Over the past year, his administration has pressured the Fed for more aggressive interest rate reductions, asserting that current rates hinder economic growth.

Miran’s Stance on Economic Policy

Since taking office in September, Miran has advocated for reduced interest rates, cautioning that a recession could loom if the Fed doesn’t act swiftly. He has dissented in four meetings, arguing for more substantial half-point cuts rather than the quarter-point reductions implemented last year.

The Federal Reserve lowered rates three times in 2022, but Miran’s positions reflect a desire for more decisive action to stabilize the economy.

In summary, Stephen Miran’s resignation from the White House signals not only a shift within the administration but also may alter the trajectory of Federal Reserve policies moving forward.