Top Silicon Valley Investors Joined Epstein in Backing Crypto Firm Coinbase

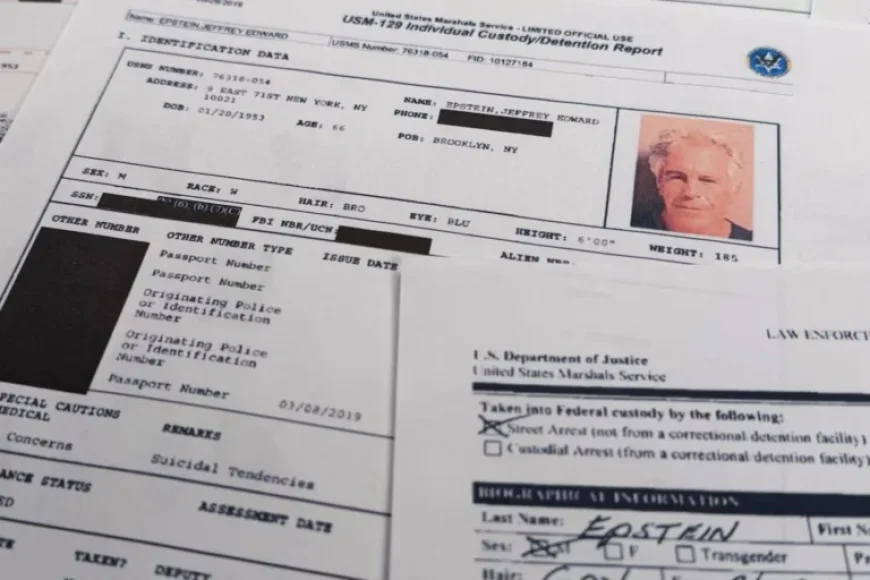

In an unexpected twist that intertwines finance with moral implications, convicted sex offender Jeffrey Epstein’s $3 million investment in cryptocurrency start-up Coinbase in 2014 has come to light, following the release of Justice Department documents. This investment granted Epstein a seemingly minor role in the ascent of what has become a monumental entity in the financial landscape—a public company with a staggering valuation of $51 billion, claiming its place as the largest U.S.-based crypto exchange.

Exposing Strategic Alliances

This revelation not only prompts a reevaluation of the stakeholders involved but also highlights the intricate web of Silicon Valley connections. Epstein’s backing of Coinbase, alongside investments from noted figures in the tech industry, suggests a concerted effort to integrate cryptocurrency into mainstream finance long before its current boom. By backing Coinbase, Epstein may have seen the potential for digital currency as a tactical hedge against the stigma surrounding his legal troubles, aiming to carve out influence in a rapidly growing sector.

Behind the Curtain: Stakeholder Analysis

| Stakeholder | Before Investment | After Investment | Implications |

|---|---|---|---|

| Jeffrey Epstein | Disgraced financier | Minor equity stake in a rising platform | Gaining financial leverage amid personal controversies |

| Coinbase Executives | Early-stage start-up | Increased market legitimacy | Validation through diverse funding sources |

| Investors and Shareholders | Perceptions tied to ethics | Concerns over association with Epstein | Potential backlash affecting stock viability |

| The Crypto Market | Emerging niche | Mainstream financial player | Enhanced interest and investment in crypto |

The unveiling of Epstein’s fiscal involvement with Coinbase not only raises eyebrows but also ignites discussions about ethical investment and corporate responsibility. This move serves as a tactical hedge against the reputational risks that come with controversial funding sources and reveals deeper tensions between the pursuit of profits and ethical considerations in investment practices.

Global Ripple Effects

This investment sends shockwaves across several key markets, including the US, UK, Canada, and Australia. In the U.S., where crypto has seen explosive growth, investors will be keenly analyzing how such associations could affect regulatory scrutiny. Meanwhile, the UK is grappling with its regulatory frameworks for crypto-assets, and Epstein’s involvement might complicate investor sentiment. In Canada, where public support for cryptocurrency continues to flourish, this news may spark debates over the ethical implications of investment backing. Australia, with its burgeoning interest in crypto, will likely see intensified discussions around corporate governance.

Projected Outcomes

As the dust settles, several developments are worth monitoring:

- Investor Sentiment: The immediate impact of Epstein’s revelation may lead to a decline in investor trust, which could affect Coinbase’s market performance.

- Regulatory Scrutiny: Increased attention from financial regulators might emerge, pushing Coinbase to implement more robust ethical investment policies.

- Public Perception: The association with Epstein may catalyze broader discussions around the ethics of investing in controversial figures in the tech landscape.

As we look ahead, these dynamics will shape the narrative around Coinbase, the crypto industry, and broader Silicon Valley investment practices, marking a pivotal moment in the convergence of morality and finance.