Scott Bessent Exposes Impact of Trump’s Tariffs on Inflation

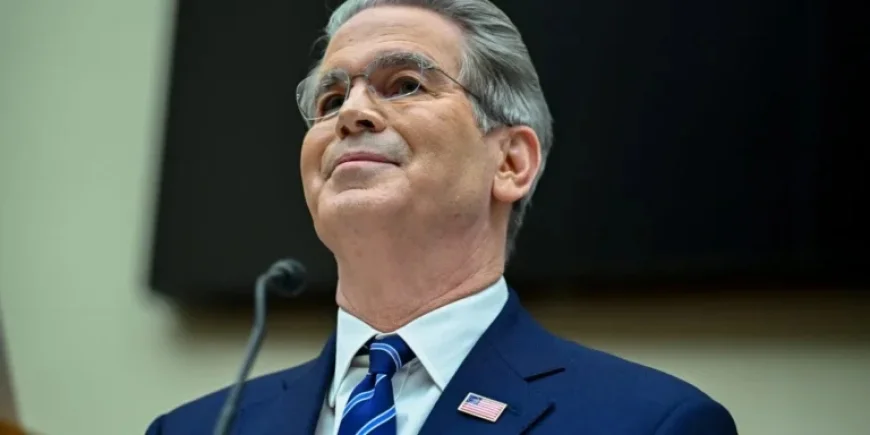

During a recent House Financial Services Committee hearing, an explosive confrontation unfolded as Treasury Secretary Scott Bessent clashed with ranking member Maxine Waters (D-Calif.). The primary focus was on President Trump’s tariff policies and their economic repercussions, particularly regarding inflation and housing costs. Waters’ aggressive questioning laid bare the conflicts in Bessent’s past statements about tariffs, revealing the potential chaos these policies could wreak on American consumers, especially as inflation hits households hard.

Escalating Tensions: Waters vs. Bessent

The exchange began when Waters challenged Bessent on his apparent shift in economic philosophy regarding tariffs. She pressed him on whether he had previously advised hedge fund investors that “tariffs are inflationary,” to which Bessent curtly replied “no.” This statement was particularly troubling given reports from El-Balad indicating that he had, in fact, warned investors just months ago about the inflationary impacts of tariffs. Such contradictions raise essential questions: Are tariffs truly an inflationary tax or just a convenient scapegoat?

The debate escalated when Waters cited past comments from Bessent in which he dismissed the inflationary effects of tariffs entirely. Bessent’s reliance on historical data from the San Francisco Federal Reserve, indicating that tariffs constitute a small percentage of GDP, stands at odds with Waters’ argument. She pointedly questioned the administration’s rationale in announcing tariff reductions on goods like coffee and bananas, asking, “Why was that announcement even necessary if tariffs aren’t inflationary?” This pivotal moment highlighted the discordance between economic theory and on-the-ground consumer realities.

Triggering a Crisis in Housing Affordability

The momentum of the hearing shifted dramatically as the topic of housing affordability emerged. Waters charged that Trump administration tariffs on key construction materials like lumber and steel threaten to exacerbate an already dire housing crisis, potentially leading to “half a million fewer homes built.” Bessent attempted to counter by claiming that lumber prices are at historic lows, a statement quickly debunked as inaccurate. When he interjected in a disruptive manner, Waters retorted with, “You don’t get to talk,” reflecting the rising animosity and urgency of the exchange.

As both representatives argued over the broader implications of tariffs on the housing market, it became clear that Bessent’s stance—that tariffs do not significantly contribute to overall inflation—is in stark contrast to growing evidence suggesting otherwise. Waters’ assertions indicated a clear understanding of the straightforward economic principle: Costs for consumers will inexorably rise in response to tariffs, regardless of their theoretical economic footprint.

| Stakeholder | Before Hearing | After Hearing |

|---|---|---|

| Consumers | Stable pricing on imports | Increased costs due to tariffs |

| Home Builders | Affordable construction materials | Rising material costs, fewer homes built |

| Investors | Clear tariff implications | Confusion over policy impacts |

Localized Ripple Effects Across Global Markets

The fallout from this hearing has the potential to resonate across several markets, including the US, UK, Canada, and Australia. In the US, as inflation continues to erode purchasing power for consumers, political implications could fuel significant electoral responses. In the UK, where similar economic pressures are felt, tariff debates mirror concerns over Brexit impacts. Meanwhile, Canada and Australia, which are interlinked with the US in trade, may see fluctuations in local markets due to ripple effects in consumer prices driven by US policies.

Projected Outcomes and Future Developments

As this debate continues to unfold, three key outcomes should be closely monitored:

- Increased Public Discontent: As everyday costs rise, consumer dissatisfaction with the administration’s policies may escalate, influencing public opinion ahead of upcoming elections.

- Policy Adjustments: Potential reconsideration of tariff strategies may emerge as legislators respond to escalating pressures from constituents and economic data.

- Market Volatility: Financial markets could experience volatility as uncertainties surrounding tariff policies affect investor confidence and pricing strategies.

This hearing encapsulates the broader economic tensions in contemporary society, revealing how political decisions shape everyday realities for millions of Americans—a narrative that will surely continue to evolve in the coming weeks.