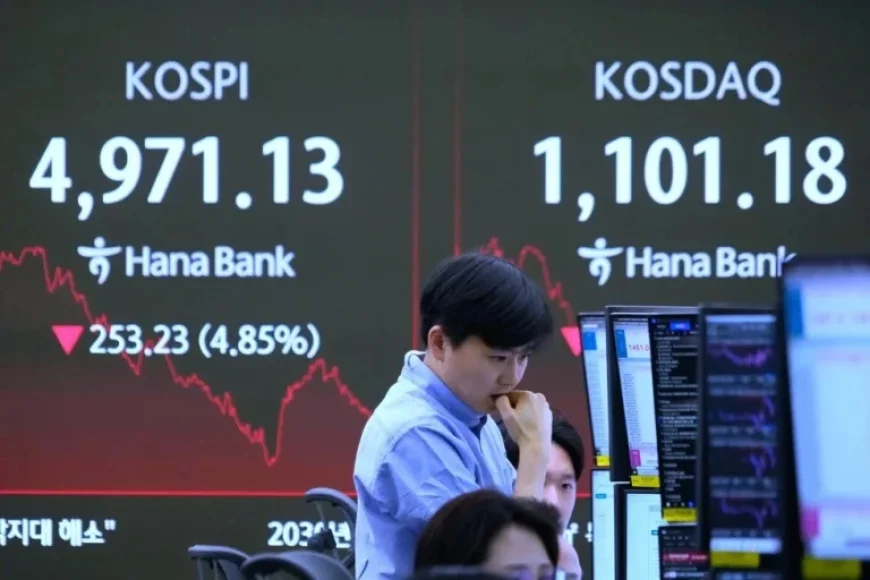

Bitcoin Drops 8% as Tech Sell-Off Drags Kospi Down 4%

Global stock markets experienced significant declines on Thursday, largely driven by a substantial sell-off in technology shares. In this volatile climate, the price of Bitcoin saw a sharp decline of 8%, trading near $71,000 at one point before plunging to approximately $69,000. This marked its lowest valuation since November 2024, according to CoinDesk.

Market Overview

The South Korean Kospi index witnessed a notable drop of nearly 4%, closing at 5,163.57. Oil prices also faced downward pressure, with U.S. benchmark crude decreasing by $1.05 per barrel, settling at $64.09.

Stock Market Performance

- Germany’s DAX: Down 0.2% to 24,568.67

- France’s CAC 40: Slightly up 0.2% to 8,278.99

- UK’s FTSE 100: Decreased by 0.3% to 10,371.83

- Asian Indices:

- Tokyo’s Nikkei 225: Down 0.9% to 53,818.04

- Hong Kong’s Hang Seng: Closed 0.1% higher at 26,885.24

- Shanghai Composite: Fell 0.6% to 4,075.92

- Australia’s S&P/ASX 200: Dropped 0.4% to 8,889.20

- Taiwan’s Taiex: Lost 1.5%

Tech Sector Struggles Amid Selling Pressure

The technology sector is currently facing intense scrutiny. Notably, Advanced Micro Devices’ shares plummeted 17.3%, despite reporting profits that surpassed analyst expectations. Investors remain cautious as speculation about future competition from artificial intelligence technologies looms.

Additionally, Uber Technologies saw a 5.1% decline after its quarterly results fell short of forecasts. The company’s future profit projections also disappointed investors. On the other hand, Super Micro Computer saw a rise of 13.8% following strong quarterly results attributed to its AI products.

Cryptocurrency Market Insights

Bitcoin’s tumble coincided with remarks from U.S. Treasury Secretary Scott Bessent, who indicated limitations on regulatory measures concerning banks’ investments in cryptocurrencies. As a result, investor confidence has wavered.

Commodities and Currency Response

The commodities market reflected ongoing instability. Precious metals displayed volatility, with gold rising by 0.2% while silver fell by 4.6%. The dollar strengthened against the Japanese yen, rising to 157.03, while the euro declined to $1.1805.

Investors are grappling with uncertainties surrounding tariffs, a potential weakening of the U.S. dollar, and escalating global debt levels. As the situation evolves, market dynamics continue to shift rapidly.