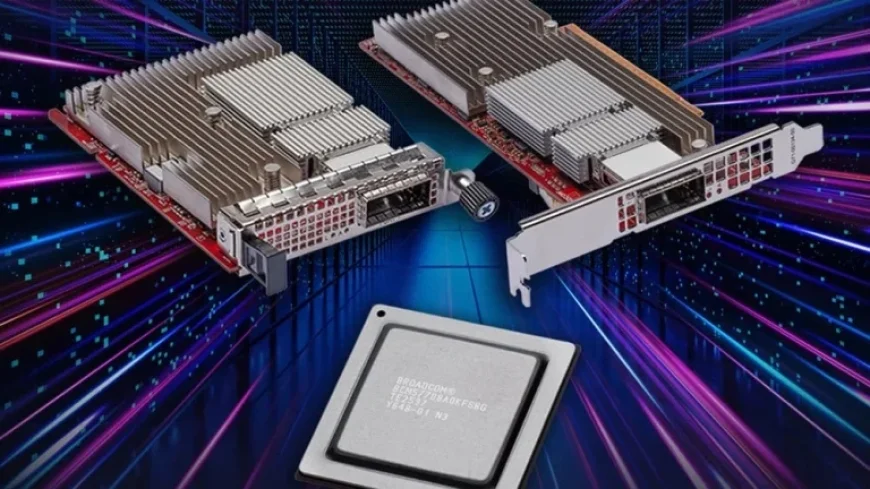

Broadcom Shares Jump Amid Google’s Significant Capex Increase

Broadcom’s shares surged following a notable announcement from Google regarding its increased capital expenditures. Analysts believe that this influx of spending will significantly benefit Broadcom, a leading fabless chipmaker.

Google’s Boost in Capital Expenditures

On Wednesday, Google’s parent company Alphabet declared its plan to nearly double its capital expenditures for the year. The spending is set to increase from $91 billion in 2025 to approximately $180 billion.

Focus on Data Centers and AI

A substantial portion of this capital will be allocated toward enhancing data centers that are crucial for running artificial intelligence applications. As AI capabilities expand, the demand for efficient and powerful chip technology intensifies, positioning Broadcom advantageously.

Market Reaction

In response to this announcement, Broadcom’s stock experienced a positive rally. Investors are optimistic about the future collaborations and contracts that may arise from Google’s increased investment in technology.

Key Takeaways

- Broadcom (AVGO) is set to benefit from Google’s increased spending.

- Alphabet plans to raise its capital expenditures to $180 billion.

- Focus areas include data centers and artificial intelligence.

Overall, the financial landscape for Broadcom looks promising as Google’s significant capex increase opens up new opportunities in the tech sector.