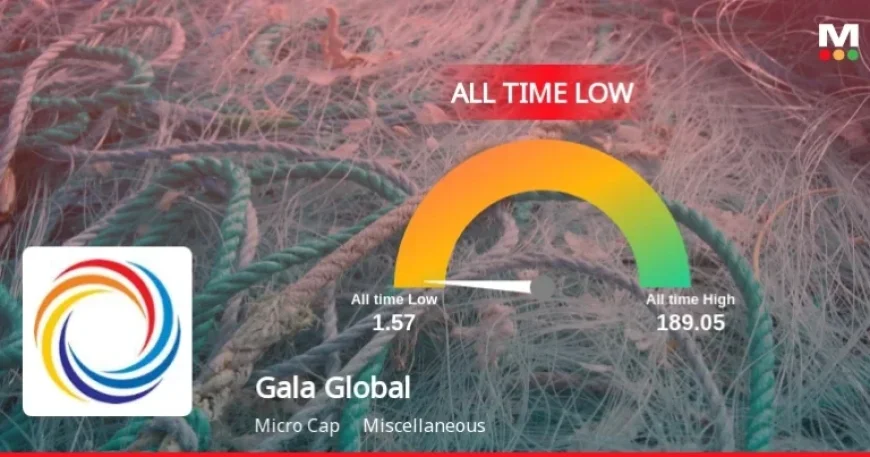

Gala Global Products Stock Plummets to Record Low in Ongoing Downtrend

Gala Global Products Ltd has seen its stock price plummet to record lows as a result of ongoing downtrends in the market. The company’s financial health has raised significant concerns among investors and analysts alike.

Stock Performance Overview

On February 6, 2026, Gala Global’s shares dropped by 2.53%, underperforming the Sensex’s decline of 0.39%. Over the past week, the stock has fallen 7.23%, contrasting sharply with the Sensex’s modest gain of 0.87%.

In the last month, Gala Global’s stock recorded a decline of 21.43%. The three-month performance indicates an even steeper fall of 40.08%. In stark contrast, the Sensex showed minimal change with a decline of -0.39% during the same timeframe.

Year-to-date, the stock has lost 23.00%, significantly worse than the broader market’s decline of just 2.62%. Over the past year, Gala Global’s share price has decreased by 58.49%, while the Sensex gained 6.31%. Long-term trends reveal an alarming drop of 82.66% over three years and 95.14% over five years. Comparatively, the Sensex enjoys increases of 37.15% and 63.58% respectively over the same periods.

Financial Health and Profitability Challenges

The financial indicators for Gala Global Products Ltd depict serious struggles. The company has reported consecutive operating losses, reflecting ongoing weaknesses in its business model. The Debt to EBITDA ratio stands at a concerning 13.56, suggesting high leverage and financial strain.

- Return on Equity (ROE): 1.90%

- Profit Before Tax excluding other income (PBT LESS OI): -₹0.26 crore (decline of 111.26%)

- Net sales over the last six months: -35.82% to ₹9.80 crore

- Profit After Tax (PAT) for the same period: -₹2.33 crore (down 35.82%)

These metrics highlight the company’s struggle with declining revenue and ongoing losses.

Valuation Considerations and Risks

Risk assessments suggest Gala Global is presently undervalued compared to its historical performance. Despite a 58.49% decline in share price over the last year, profits have significantly worsened by approximately 985%. This stark contrast raises alarms regarding the sustainability of the company’s operations.

Gala Global has consistently underperformed against benchmark indices, including the BSE500, indicating persistent challenges in regaining investor confidence. A majority of shares are held by non-institutional investors, impacting liquidity and trading dynamics.

Market Grade and Ratings Summary

As of April 7, 2025, Gala Global’s Mojo Grade was downgraded from Sell to Strong Sell due to its deteriorating fundamentals and poor market sentiment. The company has a Mojo Score of 3.0, consistent with the Strong Sell designation. Furthermore, its Market Cap Grade is 4, indicating a relatively modest market capitalization within its sector.

The stock currently trades close to its 52-week low, emphasizing the ongoing downward pressure and significant headwinds facing the company in the miscellaneous industry sector.

Conclusion

The decline of Gala Global Products Ltd’s share price to an all-time low signals a continued struggle with financial stability and market performance. Weak profitability, high leverage, and diminishing sales are contributing factors to its adverse valuation and ratings. Investors are advised to stay informed as the situation develops within the broader market context.