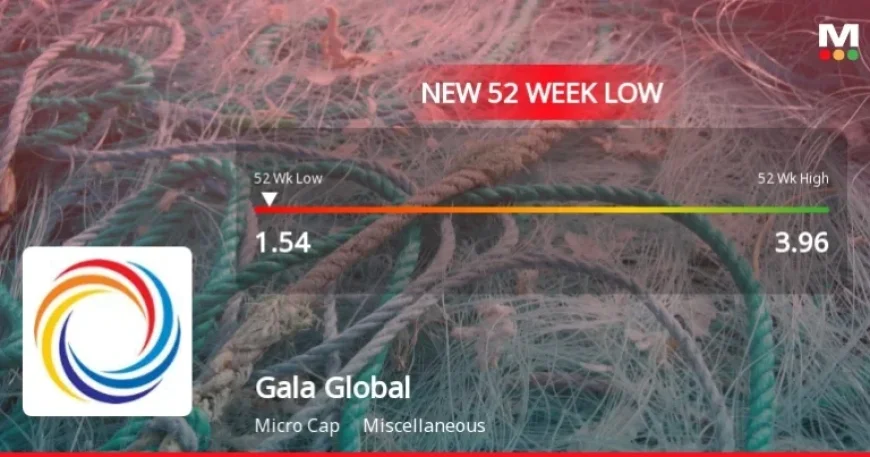

Gala Global Products Ltd Hits 52-Week Low at Rs.1.54

The stock of Gala Global Products Ltd has reached a new low, closing at Rs.1.54, marking its lowest point in the past year. This significant drop of 1.90% occurred despite the company outperforming its sector, which is indicative of broader market challenges.

Stock Performance Overview

Over the last twelve months, Gala Global Products Ltd has faced considerable setbacks, with a staggering decline of 58.22% in its stock price. In contrast, the Sensex index recorded a positive return of 6.49% during the same timeframe. The 52-week high for the stock was Rs.3.96, underscoring the severity of its recent price erosion.

- Current stock price: Rs.1.54

- 52-week high: Rs.3.96

- Decline in stock price: 58.22% over 12 months

- Sensex performance in the same period: +6.49%

Market Context and Trading Environment

The broader market index, Sensex, opened flat but later decreased by 0.23% to 83,125.70 points. It remains 3.65% below its peak of 86,159.02, and is also trading below its 50-day moving average, while its 200-day moving average remains higher, suggesting mixed market conditions.

Financial Health and Profitability

Gala Global Products Ltd is currently grappling with significant financial challenges. The company reported negative results for the last three consecutive quarters, with a Profit Before Tax (PBT) of Rs.-0.26 crore. This represents a worrying decline of 111.26% year-on-year.

- Current PBT: Rs.-0.26 crore

- Net sales for six months: Rs.9.80 crore (down 35.82%)

- Profit After Tax (PAT): Rs.-2.33 crore (down 35.82%)

With a high Debt to EBITDA ratio of 13.56 times, the company faces elevated financial risk. The average Return on Equity (ROE) stands at just 1.90%, indicating limited profitability for shareholders.

Valuation and Risk Assessment

The stock is rated with a Mojo Score of 3.0 and a current grade of Strong Sell, reflecting growing concerns regarding its financial stability and market performance. Gala Global Products Ltd has experienced a drastic 985% deterioration in profits over the past year, intensifying fears about the sustainability of its earnings.

Majority shareholding resides with non-institutional investors, potentially affecting liquidity and trading dynamics. The stock’s ongoing underperformance against benchmark indices signals continuing challenges in reversing its downward trend.

Conclusion

The decline in Gala Global Products Ltd’s stock price to Rs.1.54 epitomizes the company’s struggle with weak financial results, high debt levels, and declining sales growth. Despite overall market stability, the stock faces persistent downward pressure, trading significantly below major moving averages. The combination of low ROE and a high Debt to EBITDA ratio presents a cautious outlook for investors.