4 Reasons Tech Stocks Plunged into Meltdown This Week

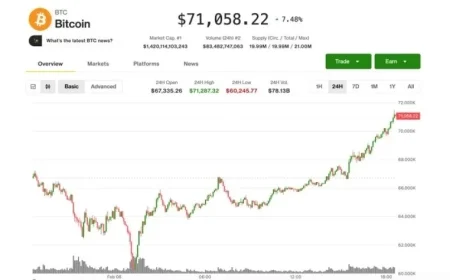

The recent sell-off in tech stocks came to a sudden halt on Friday as investors re-entered the market, propelling the Dow to an impressive gain of 1,102 points, marking a historic milestone of 50,000 points for the first time. This resurgence lifted the tech-heavy Nasdaq by 1.9% and the S&P 500 by 1.74%. While these gains provide temporary relief, they come on the heels of significant losses, including a warning that investors are shifting focus towards the long-term viability of tech stocks amid growing concerns about AI’s disruptive potential. As the market grapples with these tensions, understanding the underlying motivations reveals much more than mere numerical shifts.

The Inevitable Shift: Winners and Losers in the AI Era

This week’s events illustrate a tactical shift in investor mentality, now favoring specific tech companies based on their resilience in the face of AI challenges. “Recent months have seen a shift from the ‘every tech stock is a winner’ mindset to a more brutal landscape of winners and losers,” noted Jim Reid, head of global macro research at Deutsche Bank.AI tools are not merely augmenting software companies; they are posed to disrupt existing business models, creating palpable fear among investors who worry about diminishing market shares.

| Stakeholder | Before the Sell-off | After the Rebound |

|---|---|---|

| Investors | Confident in broad tech investments | Selective, focusing on specific winners |

| Tech Companies | High valuations, broad enthusiasm | Skepticism towards spending on AI infrastructure |

| Software Firms | Assured revenue streams | Fear of AI replacing specialized tools |

Friday’s strong rebound illustrates not just a reaction to market trends, but a collective effort among investors to secure their positions as the landscape becomes increasingly precarious. The recent announcement by AI startup Anthropic regarding new legal industry tools further exacerbated worries that companies could soon forgo specialized software subscriptions, calling into question the sustainability of software firms’ revenue models.

Global Ripples: The International Impact

This seismic shift is not limited to American markets. The turbulence created by these disruptions can be felt across global economies, affecting tech stocks in the UK, Canada, and Australia. In the UK, AI dependency in financial services raises concerns over the viability of traditional firms, while Canadian tech companies are navigating increasing scrutiny over valuations. In Australia, investments in AI are accelerating, but the apprehension surrounding tech stocks limits broader market confidence.

Projected Outcomes: What Lies Ahead for Tech Stocks?

As investors recalibrate their strategies, several key developments are poised to shape the upcoming landscape:

- Selective Investment: Investors will increasingly demand evidence of profitability tied to AI infrastructure spending. This selective approach will favor companies that demonstrate clear and sustainable growth.

- Market Volatility: Expect heightened volatility as tech stocks react to quarterly earnings reports, which will need to reflect the efficacy of investments in AI capabilities.

- Regulatory Scrutiny: Governments may step in to regulate AI integrations, adding another layer of uncertainty that could impact valuations and investment strategies.

In summary, while Friday’s rally offers a momentary respite amid the turmoil, the long-term outlook requires careful navigation. Investors who can identify resilient winners within the tech landscape will likely find opportunities, while those tethered to outdated models may face inevitable setbacks as the role of AI continues to evolve.