Stellantis Resets Business Plan, Faces Massive Charges as Shares Plummet

Stellantis, the parent company of Jeep and Chrysler, is undergoing a significant reset of its business strategy. This move comes as a response to disappointing returns from its investments in electric vehicles (EVs). The company has announced plans to incur charges exceeding $26 billion, primarily stemming from write-offs related to canceled EV products and the costs associated with resizing its EV supply chain.

Stellantis Faces Plummeting Shares and Financial Challenges

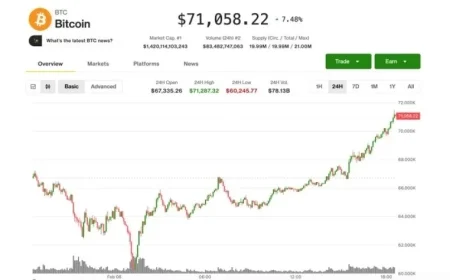

This announcement led to a dramatic drop in Stellantis shares, which fell by as much as 30%. The revision in strategy mirrors recent expensive adjustments made by other major automakers like Ford and General Motors. The automotive sector in the United States has invested heavily in EV initiatives, driven by stringent environmental regulations initiated by the current administration. However, changes in government policy have altered the landscape for these investments.

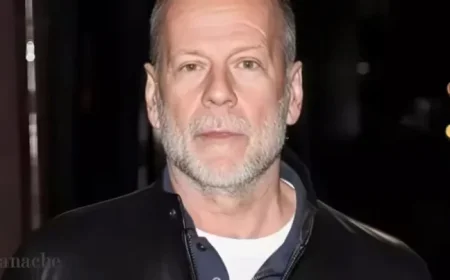

CEO Insights and Strategic Shift

Antonio Filosa, CEO of Stellantis, commented on the announced charges of €22.2 billion (approximately $26.2 billion), noting that they reflect an overestimation of the speed of the energy transition. The company emphasized its belief that the shift to electric vehicles should be guided by consumer demand rather than regulatory mandates. Stellantis aims to cater to a diverse customer base, including those who prefer hybrid and advanced internal combustion engine vehicles.

Re-alignment of Product Plans

- Majority of charges: €14.7 billion ($17.37 billion) related to realigning product plans.

- Focus on customer preferences and new emission regulations in the U.S.

Stellantis also revealed a net loss for the previous year, leading to the decision not to pay an annual dividend in 2026. However, Filosa expressed optimism, indicating that the company expects to be profitable throughout 2026.

Regulatory Landscape and Market Conditions

A recent regulatory change within the European Union adds complexity to the transition toward cleaner vehicles. Initially planning a ban on the sale of new combustion engine vehicles by 2035, the EU executive branch has now decided that this ban will only apply to 90% of new vehicles. Consequently, 10% of vehicles manufactured post-2035 may still include plug-in hybrids or internal combustion engines.

Market demand for electric vehicles in Europe has not met manufacturers’ expectations, partly due to insufficient charging infrastructure. Additionally, the environmental implications of manufacturing different vehicle types present challenges.

Life Cycle Emissions and Manufacturing Impact

Research indicates that fully electric vehicles are, on average, 40% more carbon-intensive to produce than their hybrid or gasoline counterparts. However, while gas-powered cars are cleaner to manufacture, they produce higher pollution levels throughout their operational life. Conversely, electric vehicles tend to emit 40% less carbon overall compared to gas-powered vehicles over their lifetime.

As Stellantis resets its business plan and confronts substantial financial charges, the future of its vehicle offerings will likely be shaped by consumer demand and evolving regulatory measures. The automotive industry continues to navigate the complex landscape of environmental policies and market preferences in its quest for sustainable mobility solutions.