Introducing the Gradual Print Revolution

February 8, 2026 marks a significant point in discussions surrounding the Federal Reserve’s monetary policy. The Fed is transitioning from a long-term balance sheet reduction strategy to a new phase of expected long-term balance sheet expansion. This shift comes amidst ongoing liquidity challenges in overnight financing markets. Consequently, the Fed has initiated what is known as the “Gradual Print,” a more cautious approach to monetary expansion compared to previous large-scale money-printing initiatives.

The Gradual Print: Understanding the Shift

In light of recent liquidity shortages, the Federal Reserve announced its plan to increase its balance sheet on an ongoing basis. This adjustment aims to ensure adequate reserves in the banking system while maintaining control over interest rates. The Fed plans to let mortgage-backed securities mature while increasing its holdings in treasury securities of up to three years in duration.

Purchase Strategy and Timeline

- Initial purchases of $40 billion per month.

- Expected to continue through April 2026, coinciding with tax season.

- Fed Chairman Jerome Powell anticipates a baseline growth rate of $20-$25 billion monthly thereafter.

These measures are intended to buffer the system against the usual liquidity drawdown that occurs during tax season. As Powell noted, the intent is to prepare for seasonal fluctuations while aiming for stability in the financial sector.

Implications of Continued Balance Sheet Expansion

The Federal Open Market Committee (FOMC) also anticipates a balance sheet increase of approximately $220 billion over the next 12 months. This growth corresponds to roughly $20 billion per month, which Powell believes falls on the higher end of projections. The Fed’s methodology involves creating new bank reserves to purchase treasuries, thereby increasing both its assets and liabilities, while enabling the U.S. Treasury to partially monetize its debt.

Quantitative Easing vs. Gradual Print

There is an ongoing debate around what constitutes quantitative easing. Traditional quantitative easing (QE) typically involves longer-duration bond purchases aimed at stimulating the economy. In contrast, the current fed strategy focuses more on maintaining reserves without the explicit purpose of economic stimulation.

Projected Scenarios for 2026

Looking ahead, various scenarios exist regarding the Fed’s balance sheet expansion for 2026:

- Baseline estimate: $220 billion to $375 billion increase based on current projections.

- Potential for higher figures if unexpected economic pressures arise, such as recession or geopolitical tensions.

Recent economic conditions have historically shown that balance sheet expansions are closely tied to asset performance, which in turn influences fiscal health.

Global Factors Impacting Financial Markets

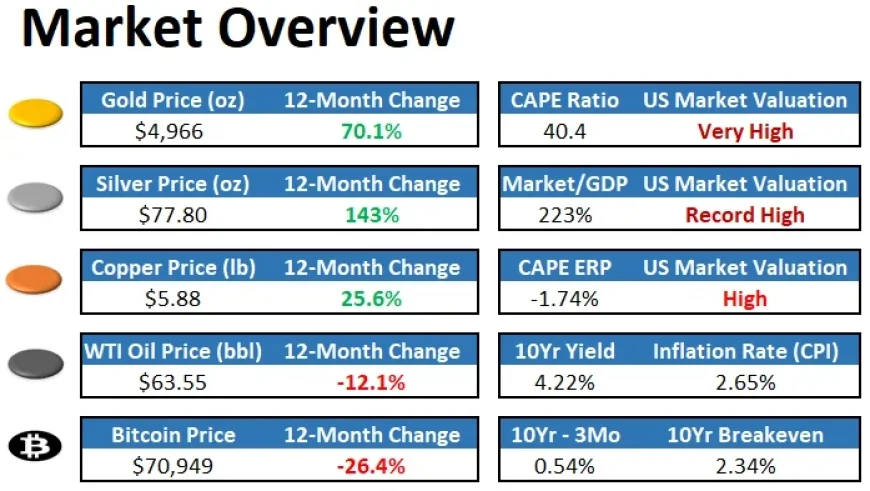

Meanwhile, Japan faces its own challenges with rising bond yields in a high-debt environment. As Japan’s debt-to-GDP ratio exceeds 200%, any increase in yields could substantially escalate government interest expenses. Despite concerns about potential fiscal crises, Japan holds a robust position due to significant foreign exchange reserves that can be utilized to stabilize its economy.

Investment Landscape Adjustments

In the current climate of impending balance sheet expansion and rising liquidity measures, investment strategies demand adjustment. The volatility of precious metals, which have surged in value recently, requires careful consideration. Since the global financial landscape is in a state of evolution, investors are advised to seek high-quality assets while being mindful of valuations and overall market dynamics.

Conclusion: Navigating Through Change

The shift towards a “Gradual Print” by the Federal Reserve and other global economic conditions highlight a period of uncertainty. While the U.S. banking system remains well-capitalized, future scenarios could result in variations that exceed current expectations. Staying informed and adaptable will be crucial for both policymakers and investors as the fiscal landscape continues to evolve.