AI and Embedded Finance Propel Fintech Innovation Towards 2026

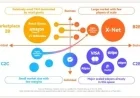

Fintech innovation is on the brink of a transformative wave leading into 2026. Key drivers such as Agentic AI, embedded finance, and real-time payments are transitioning from trial phases to full-scale implementations across the financial landscape.

Key Drivers of Fintech Innovation Towards 2026

As fintech solutions continue to evolve, stakeholders are investing more heavily in AI technologies tailored for banking and regulatory tech (RegTech). This growth points to increased revenues from wallet applications, buy now pay later (BNPL) services, and cross-border payments.

- Agentic AI: Moves beyond simple chatbots, enabling banks to automate numerous tasks including onboarding and fraud detection.

- Embedded Finance: SaaS platforms leverage financial services like accounts and cards to enhance average revenue per user (ARPU).

- Real-Time Payments: Networks such as FedNow allow for immediate transactions, improving cash flow and reducing reliance on traditional cards.

Agentic AI’s Role in Banking

The advancement of Agentic AI is streamlining multiple banking operations. U.S. banks are beginning to utilize this technology in call centers and fraud monitoring, ultimately enhancing decision-making speed and lowering operational costs.

Prominent advantages include:

- Increased cross-selling opportunities

- Reduced handling times

- Improved accuracy in underwriting processes

Secure data access and compliance with regulatory requirements are critical for successful AI integration.

Embedded Finance Enhances User Experience

Embedded finance is revolutionizing how financial services are delivered through everyday software. Platforms are adding accounts and payment solutions, creating seamless customer experiences. This approach is expected to:

- Elevate engagement with innovative payment features

- Lower transaction costs for merchants

- Increase conversion rates through streamlined payment processes

Open Banking and Real-Time Payment Solutions

Open banking APIs facilitate transaction initiation and account verification, which are crucial for modern finance. Real-time payment networks support functionalities such as:

- Instant payroll disbursements

- Swift bill payments

- Timely insurance claims processing

These enhancements enable institutions to enhance customer experience while ensuring robust fraud detection measures are in place.

Implications for Investors

Investor interest in fintech innovation remains strong as revenue models shift. Platforms that integrate software with financial services are positioned to benefit from enhanced margins and customer retention.

- Watch for companies with solid distribution channels

- Focus on effective data governance

- Monitor trends in fraud prevention and operational efficiency

Investors should look for indicators such as reduced fraud rates, improved service efficiency, and customer loyalty in their evaluations.

Conclusion

The fintech landscape is undergoing significant changes led by advancements in Agentic AI, embedded finance, and real-time payment innovations. These shifts are not merely technological upgrades; they fundamentally alter revenue structures, risk management strategies, and customer engagement.

Stakeholders are encouraged to keep an eye on the partnership dynamics and financial metrics as these innovations reshape the future of finance leading into 2026.