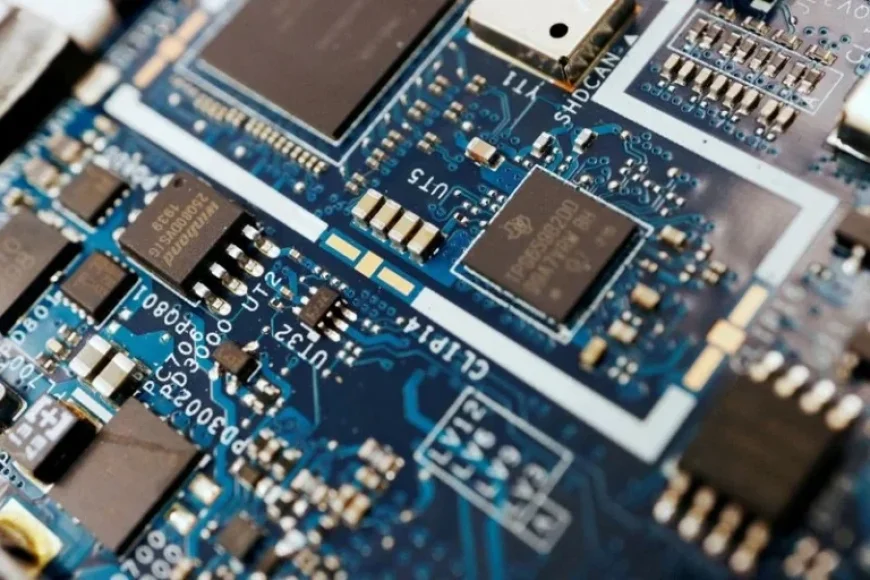

Taiwan Asserts 40% Chip Capacity Shift to US Is ‘Impossible’

Taiwan’s semiconductor capabilities face challenging pressures as the U.S. pushes for a significant relocation of its chip production capacity. Recent comments from Taiwan Vice Premier Cheng Li-chiun, stating that moving 40% of Taiwan’s semiconductor capacity to the U.S. is “impossible,” underscore the complexities of this geopolitical tug-of-war. This pushback highlights deeper motivations behind U.S. ambitions and Taiwan’s commitment to its domestic semiconductor ecosystem.

Strategic Defiance Against American Pressure

Cheng’s assertions reveal a growing frustration within Taiwan regarding U.S. demands. For decades, Taiwan has built a robust semiconductor ecosystem that is pivotal not only for its economy but also for global supply chains. The U.S. aims to shift a major chunk of this production closer to home, motivated by national security concerns and the quest for technological independence from China. “You can’t have all semiconductor manufacturing 80 miles from China,” remarked U.S. Commerce Secretary Howard Lutnick, emphasizing the urgency of relocating production.

This tactical hedge against perceived economic vulnerabilities marks a critical phase in Taiwan-U.S. relations. While Cheng acknowledged the desire to expand Taiwanese investments in the U.S., she firmly stated that Taiwan’s science parks and existing semiconductor production would remain firmly embedded on the island. This stance illustrates a dual strategy: assert Taiwan’s invaluable role in global semiconductor manufacturing while also opening pathways of collaboration with the U.S.

Impact on Stakeholders

| Stakeholder | Before | After |

|---|---|---|

| Taiwan Semiconductor Industry | Firm foothold in global market | Enhanced investment and growth expectations |

| U.S. Government | Reliant on Taiwanese supply | Seeking to build domestic capabilities |

| Global Tech Companies | Dependent on steady supplies | Potential shake-up in supply chain dynamics |

The Ripple Effect Across Global Markets

This pivotal moment has significant ramifications extending beyond Taiwan and the U.S. In the UK, Canada, and Australia, tech companies closely monitoring the Taiwan situation may reevaluate their supply chains. A shift in Taiwanese semiconductor production could disturb the established order in semiconductor availability, leading to industry-wide ramifications.

Furthermore, the push towards U.S. manufacturing could incite other nations to reconsider their semiconductor strategies, amplifying the global race for technological supremacy. If Taiwan remains staunch in its commitments, countries like South Korea and Japan may seek to capitalize on the opportunity to expand their own semiconductor industries in response to any potential shortages created by U.S.-Taiwan tensions.

Projected Outcomes

Looking ahead, three developments are likely to shape the semiconductor landscape in the coming weeks:

- Increased U.S.-Taiwan Collaboration: Expect a series of bilateral discussions aimed at enhancing knowledge transfer and investment synergies without massive relocations.

- Potential Tariff Adjustments: Rising tensions could lead to tariffs on Taiwanese exports if the U.S. feels Taiwan is not sufficiently accommodating its demands.

- Emergence of Alternative Supply Chains: Competitors in Asia may seize the moment to bolster their semiconductor offerings if Taiwan faces constraints, potentially altering the competitive landscape.

Taiwan’s defiance of American manufacturing requests highlights a resilient commitment to its semiconductor heritage. As both nations seek to define their roles in the global supply chain, the resulting dynamics will have lasting implications for technological security and economic strategies worldwide.