Consider These 2 AI Stocks Over Tesla for Investment Now

Recent trends in the market highlight a notable shift in focus from traditional electric vehicle (EV) stocks to emerging players in artificial intelligence (AI). While Tesla has enjoyed substantial growth over the past decade, its current trajectory raises concerns for investors.

Current Challenges for Tesla

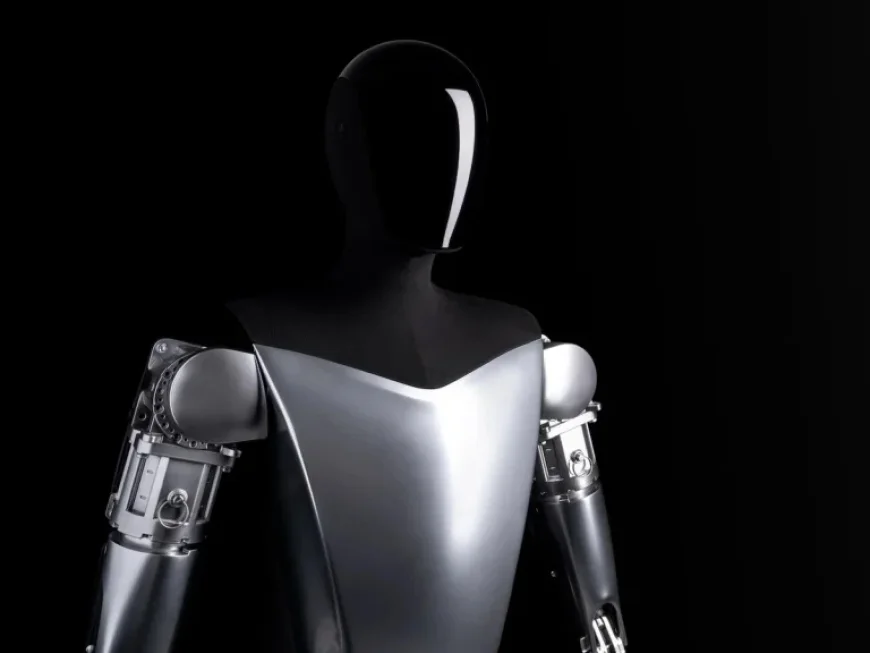

Tesla’s stock has soared by 3,500% over the last ten years. However, the company is undergoing a major transition, moving towards robotics and autonomous vehicles (AVs). This shift could pose risks for Tesla shareholders.

Declining Sales and Rising Costs

In the fourth quarter, Tesla reported declining sales, marking its first annual revenue drop at $94.8 billion. With rising operational expenses of 39%, totaling $3.6 billion for the quarter, the company’s financial health appears strained. Moreover, the net income plummeted by 60%, resulting in earnings of only $0.24 per share.

To pursue its ambitions in robotics and AVs, Tesla plans to invest over $20 billion this year. The exorbitant price-to-earnings (P/E) ratio of 390 further complicates matters, significantly overshadowing the tech sector average of 42. This situation renders Tesla shares quite expensive during a transitional phase.

Investing in AI Stocks: Micron and TSMC

Investors looking for better opportunities might want to consider Micron Technology and Taiwan Semiconductor Manufacturing Company (TSMC). These companies are not just surviving but thriving in the AI sector.

Market Leadership and Growth Potential

- Micron Technology: Specializes in memory chips essential for AI data centers. Its fiscal first-quarter revenue grew 56% to $13.6 billion, while adjusted earnings rose 167% to $4.78 per share.

- Taiwan Semiconductor: Holds a commanding 70% of the processor manufacturing market. Its first-quarter sales increased by nearly 26% to $33.7 billion, with diluted earnings growing 35% to $3.14 per American depositary receipt (ADR).

As AI infrastructure demand continues to rise, Nvidia projects that spending will reach between $3 trillion and $4 trillion by 2030. This trend positions Micron and TSMC favorably for ongoing growth.

Affordability Compared to Tesla

From a valuation perspective, Micron and TSMC are significantly cheaper than Tesla. Micron’s P/E ratio stands at 39, while TSMC’s is approximately 33. These figures present a more appealing investment opportunity when compared to Tesla’s inflated valuation.

In conclusion, while Tesla has been a formidable player in the stock market, its current challenges warrant caution. Micron and TSMC represent promising alternatives for investors seeking exposure to the burgeoning AI sector. Consider these two AI stocks over Tesla for investment now.