Paramount Agrees to Cover $2.8M Netflix Termination, Compensate Shareholders

Paramount has revised its acquisition proposal for Warner Bros. Discovery, introducing a $2.8 billion termination fee to Netflix and a new shareholder compensation structure. This updated offer aims to enhance Paramount’s bid amidst the ongoing competition with Netflix.

Key Details of Paramount’s Offer

- Paramount will maintain an offer of $30 per share for Warner Bros. Discovery.

- An additional $0.25 per share will act as a “ticking fee” for shareholders, applicable quarterly if the transaction isn’t completed by December 31, 2026.

- The $2.8 billion fee will be paid to Netflix if Warner Bros. Discovery chooses to reject its bid.

- In case Netflix withdraws, it owes Paramount $5.8 billion.

Financial Commitments and Support

Paramount has increased its equity and debt commitments significantly. The new offer includes:

- $43.6 billion in equity commitments from the Ellison Family and RedBird Capital Partners.

- $54 billion in debt commitments from financial institutions such as Bank of America, Citigroup, and Apollo.

- A personal guarantee of $43.3 billion from Larry Ellison, Paramount’s CEO David Ellison’s father.

Warner Bros. Discovery’s Response

Warner Bros. Discovery is conducting a review of the modified proposal. However, the board has not changed its recommendation for shareholders to accept Netflix’s deal. This deal, valued at $72 billion or $27.75 per share, focuses on acquiring Warner Bros. studios and its streaming business.

Strategic Moves by Paramount

As part of its aggressive strategy, Paramount has urged Warner Bros. Discovery shareholders to reject the Netflix merger, labeling it as “inferior.” The company also seeks to block the spinoff of Discovery and objectionable compensation packages for senior executives, including CEO David Zaslav.

Regulatory Compliance and Next Steps

Paramount has extended the expiration date of its tender offer to February 20, as it continues to comply with regulatory requests from the Department of Justice. This compliance has initiated a 10-day waiting period for regulatory response.

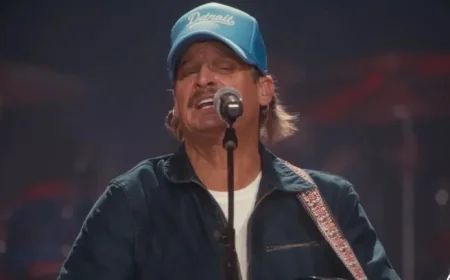

David Ellison emphasized the advantages of Paramount’s offer, stating, “Our superior $30 per share, all-cash offer underscores our commitment to delivering value to WBD shareholders.” He highlighted the financial backing and a clear path for regulatory approval as essential benefits of the revised proposal.