FBI and BBB Warn North Carolinians of Romance Scams Before Valentine’s Day

As Valentine’s Day approaches, the specter of romance scams looms large over North Carolina. The Federal Bureau of Investigation Charlotte has reported a surge in both the frequency and financial impact of confidence scams in recent years, with local victims losing millions. This stark warning comes as hundreds of North Carolinians find themselves ensnared in intricate webs of deceit, often crafted by scammers masquerading as romantic partners. Understanding the mechanics of these scams is crucial for consumers, particularly with the holiday of love on the horizon.

Decoding Romance Scams: More than Just Financial Theft

At their core, romance scams leverage fabricated online identities to garner trust and emotional investment from targets. Shelley Lynch, a public affairs officer with the FBI Charlotte, elaborates on the tactics scammers employ. “They start by flattering potential victims. They mirror shared sentiments… creating an artificial emotional connection,” Lynch explains. This strategy not only deceives victims but also places them in a vulnerable state, predisposing them to financial manipulation.

Scammers often use emotional coercion, convincing victims that payments are necessary for various fictional scenarios, like covering travel expenses or legal fees related to disputes. The implications are profound: these are not mere transactions; they are calculated attacks on trust and intimacy, especially intensified during Valentine’s season. “This time of year, [scammers] become particularly aggressive, targeting those looking for companionship,” Lynch warns.

Case Study: A Local Victim Caught in a Scammer’s Web

One victim, a woman from Cary, unknowingly fell into a fraudulent scheme. Engaging initially on “Coffee Meets Bagel”, she transitioned communications to WhatsApp, where she was introduced to a fake cryptocurrency trading platform. Believing she was investing in her financial security, she inadvertently funneled money into the scammer’s account.

| Before the Scam | After the Scam |

|---|---|

| Trust in online platforms | Distrust of online interactions |

| Excitement about new relationships | Emotional trauma and loss of finances |

| Financial independence | Financial insecurity and potential debt |

The Financial Toll: by the Numbers

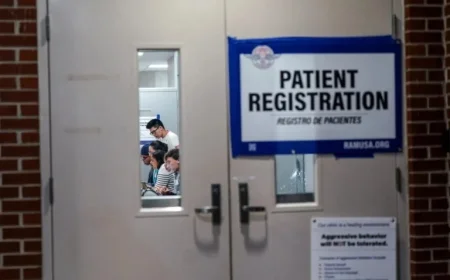

Statistics paint a grim picture. In 2024, a staggering 519 individuals in North Carolina reported losses exceeding $18.8 million in romance scams, averaging about $36,000 lost per victim. On a national scale, over 17,000 individuals fell prey to similar schemes, leading to losses that surpassed $672 million. Although there has been a slight decrease in reported cases—from approximately 2,000 fewer victims between 2022 and 2024—Lynch emphasizes that many cases remain unreported due to feelings of shame and embarrassment among victims. “Victims often experience complicated emotions and may hesitate to come forward,” she notes.

Impact Beyond Borders: A Global Perspective

The implications of romance scams stretch beyond North Carolina, echoing in markets across the US, UK, CA, and AU. Economic instabilities, along with an uptick in online dating, create an environment ripe for such frauds. As platforms evolve, so too do the tactics of scammers, necessitating widespread educational campaigns that highlight prevention tactics. Digital security measures, combined with community awareness, are vital in mitigating this growing issue.

Strategies for Prevention: Safeguarding the Heart and Wallet

Awareness is the first line of defense against romance scams. The FBI offers several critical strategies for safeguarding oneself:

- Be cautious about moving conversations off dating apps into encrypted platforms.

- Limit what you share publicly on social media. Scammers thrive on personal details.

- Use image reverse search tools to verify the identities of potential matches.

- Take your time and interrogate every charming sentiment.

- Remain vigilant for isolation tactics and demands for inappropriate photos or financial information.

Projected Outcomes: Looking Ahead

As we approach Valentine’s Day, several key developments will likely shape the response to these scams:

- Anticipation of increased scams as scammers ramp up efforts exploiting vulnerable individuals seeking romantic connections.

- Heightened collaborations among law enforcement, technology companies, and community organizations aimed at improving awareness and prevention strategies.

- Emergence of innovative digital safety measures and educational resources aimed at the public to combat the evolving tactics of romance scammers.

As victims continue to navigate the choppy waters of online relationships, accountability and transparency must rise to the forefront of consumer protection efforts. The emotional scars left by these scams may linger long after the financial loss, serving as a reminder of the necessity for vigilance in the digital age.