Workday Loses $40 Billion; Founder Bhusri Returns with $139 Million Bet

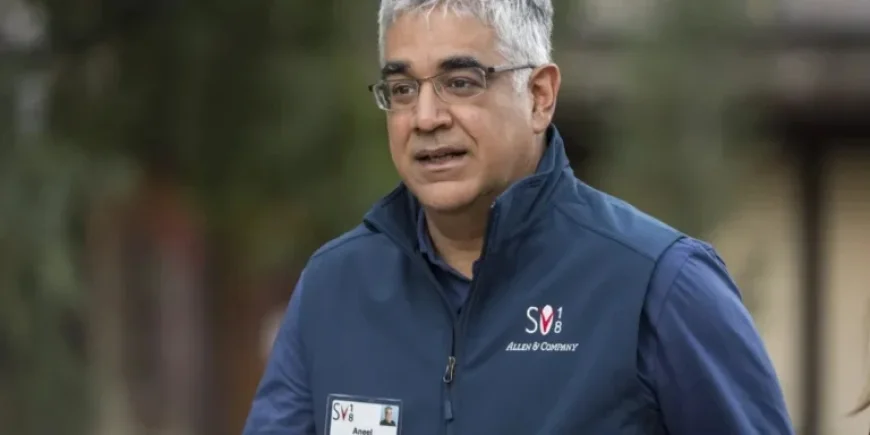

Workday Inc. is experiencing a significant leadership shift with the return of cofounder Aneel Bhusri to the CEO position. This move highlights a common trend in Silicon Valley where founders are reinstated during challenging times, particularly with the rising concerns surrounding artificial intelligence (AI) and its impact on the software industry.

Impact of AI on Workday

The return comes at a crucial moment for Workday, which has recently lost approximately $40 billion in market value due to investor fears about AI. The company’s stock plummeted by 51%, from a high of $311.28 per share to around $150, and has further depreciated by 29% this year alone. This decline reflects broader trends affecting software-as-a-service (SaaS) companies like Salesforce and ServiceNow.

Aneel Bhusri’s Compensation Package

To entice Bhusri back as CEO, Workday is offering him a substantial compensation package of $138.8 million. This package includes:

- $75 million contingent on meeting undisclosed stock price targets over the next five years.

- $60 million in restricted stock that vests over four years, provided Bhusri remains with the company.

- A base salary of $1.25 million and an annual cash bonus of up to $2.5 million.

This structure illustrates the seriousness of Workday’s current situation, recognizing the skepticism investors have regarding the company’s transition into an AI-driven market.

Leadership History and Influence

Bhusri co-founded Workday with Dave Duffield in 2005. He held key leadership roles, including a stint as sole CEO before sharing the position with Luciano Fernández in 2020. After Fernández’s departure, Bhusri returned to an executive chair role in February 2024.

Today, Bhusri has significant influence over company decisions, holding 68% of the voting power due to a dual-class share structure. This gives him the authority needed to navigate Workday through the tumultuous AI landscape.

Performance Metrics and Investor Anxiety

Despite Bhusri’s optimistic outlook for the company, there are growing concerns among investors. Following his announcement, Workday’s stock fell over 6%, reflecting uncertainty with the AI transition. The previously robust subscription revenue growth has seen a downturn, declining from 19% to just 15% over the past fiscal quarters.

As the AI landscape continues to evolve, investors will be closely monitoring Bhusri’s ability to lead Workday back to its previous heights. The company faces a reconstructed workforce and an ongoing strategic pivot aimed at aligning with AI innovations.

Future Outlook for Workday

Bhusri expressed confidence in Workday’s potential to redefine enterprise software, much like when the company was first established. The market will watch closely as he implements strategies to restore investor confidence and stabilize the company during this challenging phase.