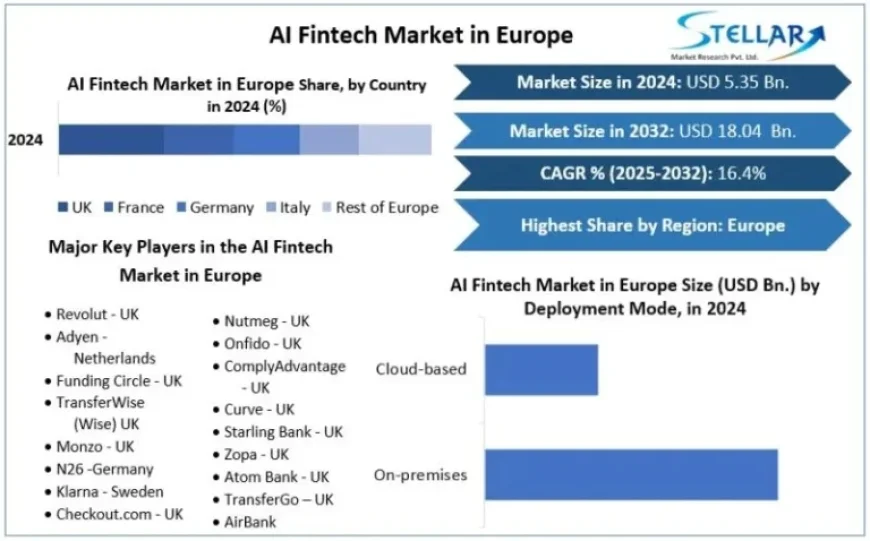

AI Fintech Market to Hit $18.04 Billion by 2032, Growing at 16.4% CAGR

The AI Fintech Market in Europe is on a promising growth trajectory, projected to reach approximately USD 18.04 billion by 2032. This dramatic expansion represents a compound annual growth rate (CAGR) of 16.4% from its current value of USD 5.35 billion in 2024. The integration of artificial intelligence into financial services is reshaping the industry landscape.

Transformative AI Applications in Finance

Artificial intelligence is rapidly becoming a core element of financial workflows across Europe. Key applications include:

- Real-time fraud detection

- Automated customer support

- Personalized credit offers

These innovations are increasingly recognized as vital tools rather than mere experiments, signaling a shift towards comprehensive AI infrastructure.

Market Dynamics Driving Growth

The growth of the AI fintech market is influenced by several key factors:

- Consumer Demand: Users expect rapid onboarding, real-time transactions, and tailored financial advice.

- Business Needs: Companies seek faster credit evaluations and automated compliance processes.

- Intense Competition: Fintech startups and established banks alike are modernizing their services.

- Regulatory Influence: Robust data protection laws and new AI governance standards shape development practices.

Key Players and Innovation Hubs

Several prominent companies are leading the charge in AI fintech innovation:

- Revolut (UK)

- Klarna (Sweden)

- Adyen (Netherlands)

- SAP (Germany)

Regions such as the United Kingdom, Germany, and France are notable for their contributions. London serves as a fintech powerhouse, while Germany focuses on enterprise solutions and compliance. France is advancing research in AI applicability within financial services.

Market Opportunities

Future growth in the AI fintech market may be fueled by several opportunities:

- Explainable AI: As regulatory frameworks evolve, demand for transparency in AI operations will increase.

- Embedded Finance: As non-financial platforms adopt payment services, AI will play a crucial role in risk management and compliance.

- SME Services: Many small and medium enterprises remain underserved; AI-driven solutions can bridge this gap.

Conclusion: A Future Reflecting Innovation and Trust

The AI fintech market in Europe represents more than just efficiency; it aims to create a financial ecosystem that aligns with consumer needs while adhering to high standards of safety and fairness. With innovation, strong regulatory practices, and a diverse talent pool, Europe is well-positioned to lead in intelligent finance solutions.