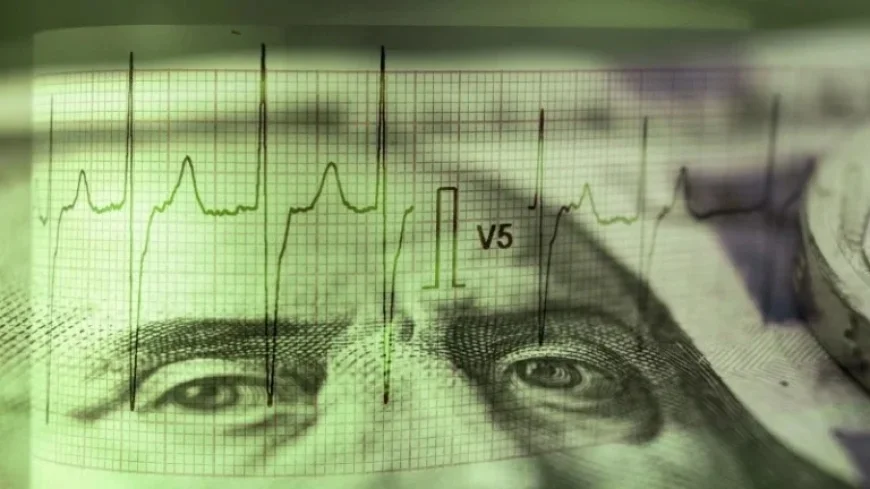

FX Daily: Seeking Signs of Dollar Momentum

This week features a lighter economic calendar, particularly for Central and Eastern Europe (CEE). Notably, Romania will release its January inflation data. Analysts anticipate a modest decrease from 9.7% to 9.4% year-on-year.

Key Economic Events in Romania

The National Bank of Romania is scheduled to hold its first policy meeting of the year on Tuesday. Expectations lean towards maintaining the current interest rate at 6.50%. The bank aims to monitor inflation closely, as a significant decline is forecasted in the coming summer months due to last year’s tax hikes.

- January Inflation Release: Expected drop from 9.7% to 9.4% YoY

- Interest Rate Meeting: National Bank of Romania, Tuesday

Rate cuts may begin as early as May, contingent on the anticipated decrease in inflation and recent GDP figures, which showed weaker performance.

Polish Economic Data

On Thursday, Poland will publish a variety of monthly economic indicators, including metrics related to the labor market and industrial output. Market observers will keenly await these figures.

Industry Output in Romania

Friday will see the release of industrial data in Romania, which could provide further insights into the economic landscape of the region.

Central Eastern Europe Currency Outlook

Recent market trends show limited movement in CEE currencies, with the exception of the Hungarian forint. Despite a weaker U.S. dollar bolstering regional currencies, the overall stability remains due to rising expectations of interest rate reductions throughout the region.

- EUR/PLN Range: Expected between 4.200-4.230

- EUR/CZK Range: Expected between 24.200-24.400

The forint has experienced some upward correction following new two-year lows after last week. However, pre-election positioning is likely to provide continued support. Any potential weakness in the forint may lead to fresh long positions in the currency.

Moreover, recent inflation data underlined that the National Bank of Hungary may enact rate cuts in its next meeting, which could temper gains seen in the forint in previous weeks.

Overall, economic developments in the region this week signal greater anticipation regarding the potential for dollar momentum and shifting currency values.