Trump’s Promised Stimulus Checks: What Happened?

The recent vote by the GOP-controlled House of Representatives to overturn President Donald Trump’s tariffs on Canada marks a significant pivot in the U.S. political landscape. This decision comes amid Trump’s ongoing discussions about a promised $2,000 stimulus check, a “tariff dividend” he claims would benefit the American public. Yet, as we dive deeper, the motivations behind this move reveal a strategic calculus aimed at balancing political allegiances and electoral prospects.

Unpacking the Vote: A Tactical Hedge

The House’s action to dismantle these tariffs can be seen as an electoral strategy designed to appeal to centrist voters and business interests hurt by escalating trade tensions. By positioning themselves as defenders of free trade, Republicans seek to mitigate potential backlash from constituents adversely affected by higher consumer prices and disrupted supply chains. This vote serves as a tactical hedge against growing dissatisfaction among key voter demographics leading into the midterm elections.

The Tension Between Promises and Reality

In a recent post on Truth Social, Trump framed the promised payments as a reflection of America’s economic strength under his administration. Despite his grand proclamations, the reality is far more complicated. The “dividend,” primarily aimed at middle and lower-income Americans, depends largely on tariff revenues, which remain in jeopardy. The looming Supreme Court decision could dismantle these tariffs, thus affecting the financial framework of Trump’s proposed checks.

Impact on Stakeholders

| Stakeholder | Before the Vote | After the Vote |

|---|---|---|

| U.S. Consumers | Face higher prices from tariffs. | Improved access to cheaper imported goods. |

| Trump Administration | Tariff revenues seen as funding for stimulus checks. | Loss of a key funding source for the $2,000 checks. |

| Republican Party | Supports Trump’s trade policies. | Shifts to appeal to constituents critical of tariffs. |

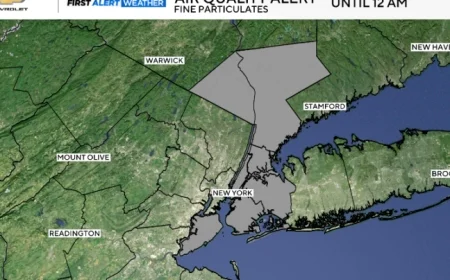

Localized Ripple Effect

This unfolding situation has implications beyond U.S. borders. In Canada, the reversal of tariffs could enhance trade relations, fostering economic recovery in sectors heavily reliant on cross-border commerce. Meanwhile, in the UK and Australia, markets are closely monitoring U.S. trade policy as it impacts their own economic frameworks and bilateral trade agreements. A resolution of the tariff issue could signal a broader shift in global trade dynamics, leading to recalibrated economic strategies across allied nations.

Projected Outcomes

The intersection of trade policy and economic stimulus introduces uncertainty. Here are three developments to watch:

- Supreme Court Ruling: A timely decision on the legality of the tariffs could directly impact the feasibility of Trump’s promised stimulus checks.

- Electoral Consequences: The House’s reversal may sway midterm election outcomes, influencing Republican strategies moving forward.

- Economic Response: Businesses may react to shifting trade policies, adjusting supply chains and pricing strategies in response to tariff changes.

In the coming weeks, as these vital decision points unfold, the implications for American consumers, businesses, and the broader economy will continue to resonate throughout the political landscape. How this narrative will evolve remains to be seen, but all eyes are on the intersection of tariffs and Trump’s economic promises.