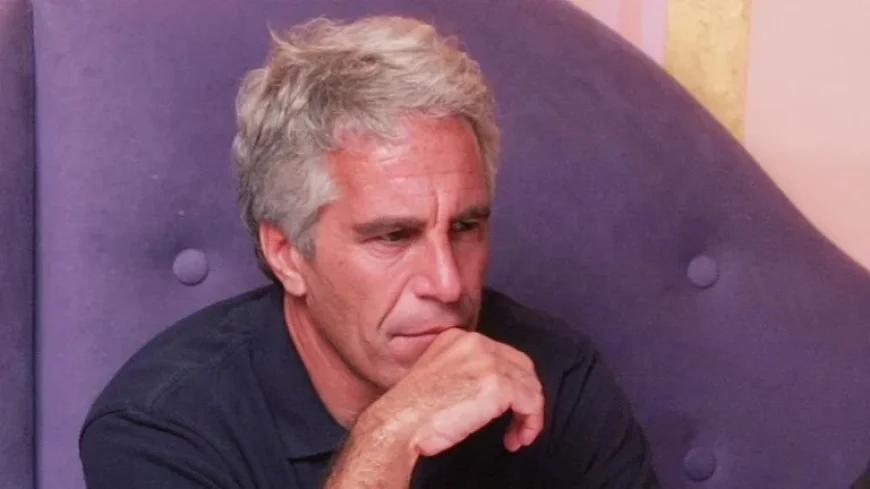

Corporate America’s Epstein Reckoning Intensifies: ‘This Is Not Over’

The fallout from the recent release of Jeffrey Epstein-related files continues to send shockwaves through Corporate America, leading to the abrupt resignations of numerous high-profile leaders. Initially, the impact appeared muted after the Justice Department’s disclosure of these documents in late December. However, as more connections between Epstein and significant business figures surface, the pressure for accountability has intensified. Billionaire Tom Pritzker of Hyatt Hotels has joined this wave, resigning due to “terrible judgment” over his ties with Epstein and Ghislaine Maxwell. His departure underscores a deeper crisis within corporate leadership as ethical standards increasingly clash with past affiliations.

This Is Not Over: A Systematic Collapse of Trust

The latest resignations — including Goldman Sachs’ Kathy Ruemmler, who faced scrutiny for her personal communications with Epstein — reveal a motif of reckoning, where corporate leaders are sacrificing their positions to sidestep negative implications. Although none have been accused of wrongdoing, the mere association with Epstein is becoming a toxic liability. Bill George, an executive fellow at Harvard Business School, warns that this is merely the “tip of the iceberg,” indicating that further revelations are likely to emerge. This evolving narrative raises questions about judgment and oversight, exposing the complex dynamics between corporate reputation and personal affiliations.

| Stakeholders | Before Resignation | After Resignation |

|---|---|---|

| Corporate Leaders | Maintained positions; facing minimal scrutiny. | Resigned to mitigate brand damage; heightened vigilance on ethical affiliations. |

| Company Reputation | Relatively unscathed; business as usual. | Deteriorating sentiment; risk of loss in client trust due to associations. |

| Investors | Focus on financial returns; limited oversight on executives’ social ties. | Increased pressure for transparency and ethical behavior; potential reevaluation of investments. |

Corporate America’s Descent into Ethical Turmoil

This crisis is not isolated to a handful of companies; it casts a wide net over corporate governance, compelling boards to scrutinize their current members comprehensively. The mention of Epstein reverberates throughout the corporate ecosystem. Nell Minow from ValueEdge Advisors emphasizes that companies are scouring the Epstein documents to safeguard their reputations and ensure they aren’t linked to any questionable pasts. This “Lutnick rule,” named after Commerce Secretary Howard Lutnick whose connections with Epstein have come under renewed scrutiny, is reshaping corporate accountability.

The repercussions of this growing scandal extend beyond American borders. The resignation of Sultan Ahmed bin Sulayem from Dubai’s DP World highlights how global economic ties are also under the microscope. In the UK, Morgan McSweeney stepped down as chief of staff to Prime Minister Keir Starmer for his involvement with Epstein-linked appointments. These developments suggest a burgeoning coalition of accountability across international spheres.

Localized Ripples across Global Markets

As the Epstein files continue to emerge, the immediate fallout is palpable across different markets.

- United States: Heightened fears of reputational damage could lead to further corporate exits and stricter due diligence practices concerning executive affiliations.

- United Kingdom: Rising calls for political accountability may affect government officials’ relationships and strategic appointments, especially within the Labour Party.

- Canada and Australia: The ripple effects could push companies and governing institutions to reevaluate their ethical standards and transparency in leadership selections.

Projected Outcomes: What Lies Ahead

Looking forward, several key developments can be anticipated:

- Increased Investigations: Expect more corporate leaders to face scrutiny, with potential investigations into their affiliations with Epstein, resulting in further resignations.

- Revised Corporate Governance Standards: Companies may adopt stricter ethical guidelines and conduct regular checks against potential liabilities, reshaping corporate governance as a whole.

- Investor Activism: Institutional investors will likely demand higher ethical standards and accountability from executives, influencing investment decisions and priorities.

In light of these profound shifts, Corporate America finds itself at a critical juncture where ethical considerations are outweighing blind ambition. The Epstein saga continues to unravel, setting a new precedent for corporate accountability and ethical behavior in leadership.