Court Documents Reveal Seafood Magnate John Risley’s Firm Owes US$776 Million

John Risley’s investment firm, CFFI Ventures Inc., is embroiled in a significant legal and financial crisis. According to recent court documents, the firm owes upward of US$776 million. This staggering debt has prompted CFFI to seek a strategic shift in ownership, filing a plan in the Nova Scotia Supreme Court.

Financial Restructuring Plan

On Tuesday, CFFI submitted a proposal to transfer its assets to a new entity as a way to stabilize its financial standing. A ruling from the court is anticipated in April regarding the approval of this plan. Risley, who leads the firm, emphasized the need for change, stating, “I have a higher tolerance for risk than most, which has driven the success and setbacks since founding Clearwater Fine Foods.”

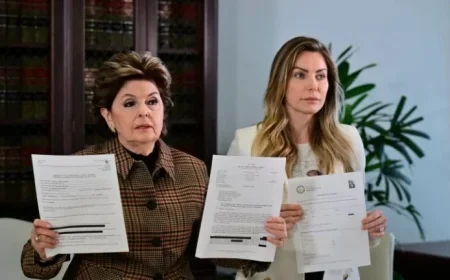

Legal Claims Against CFFI

Adding to CFFI’s troubles, Brendan Paddick, a long-time associate of Risley, has filed a lawsuit claiming that the firm owes him over $22 million. Paddick contends that he provided a substantial loan in 2018 and cites a promissory note from January 2024, claiming CFFI owes him $15.8 million plus interest. If not paid, that figure could soar to approximately $22.8 million with accrued interest.

Company Background and Other Ventures

CFFI Ventures, headquartered in Nova Scotia, is known for its diverse investments. The company plays a role in a proposed wind-powered hydrogen project in western Newfoundland and holds partial stakes in various enterprises, including Horizon Maritime and skin care firm SkinFix. Additionally, it possesses an extensive collection of artwork and other collectibles valued at $14 million.

Market Challenges and Future Outlook

According to CFFI’s vice-president and chief financial officer, Brittany Bartlett, there is skepticism regarding the monetization of assets in the near future. She also expressed doubts about whether current asset values could cover the mounting debts.

Potential Solutions for Debt Management

CFFI is negotiating a solution involving its creditors, led by New York’s HPS Investment Partners. The proposed strategy would form a new company, AcquireCo., to assume much of CFFI’s debt and assets, according to an interim ruling by Justice John Keith.

As the situation evolves, Risley is looking beyond CFFI. He is exploring various projects, including developing a subsea cable network to connect the Atlantic Canada energy grid. His commitment to these ventures reflects his resolve in navigating this challenging period.