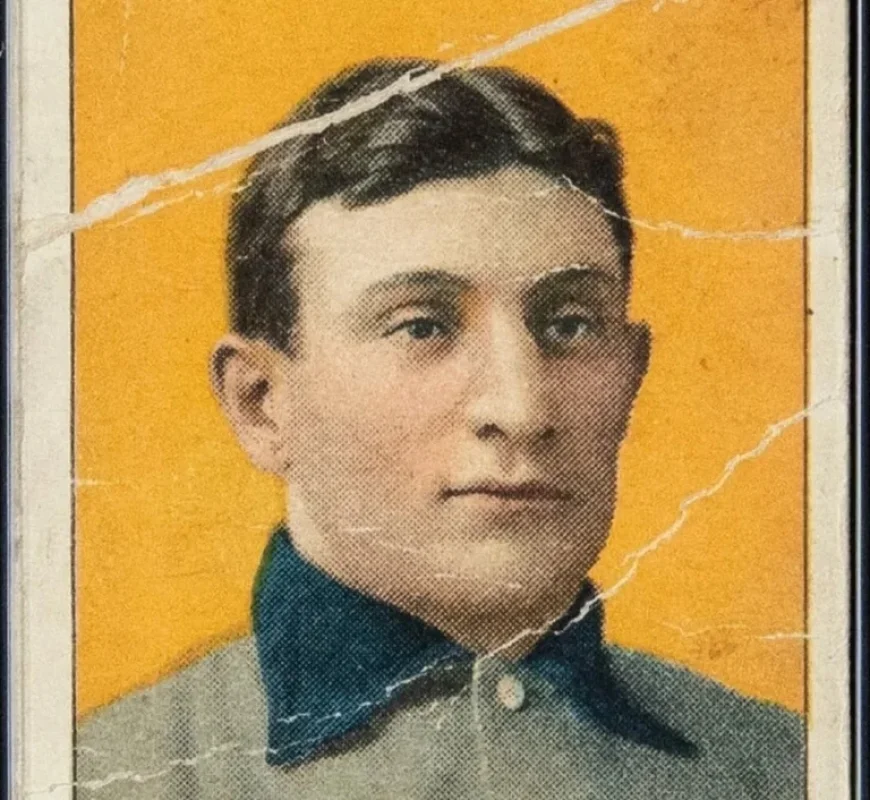

Historic T206 Honus Wagner Card Sells for $5.1M After 116 Years

A 1909 Sweet Caporal T206 Honus Wagner card, recently showcased on the Netflix series “King of Collectibles: The Goldin Touch,” has made headlines after selling for $5.124 million, marking it as one of the most expensive Wagner card transactions to date. This PSA 1 graded card (on a scale from 1 to 10) sits as the third-highest sale of the iconic T206 Wagner, igniting fierce interest in the card-collecting market. The sale represents the 16th time since 2015 that a T206 Wagner card has crossed the $1 million mark, illustrating the escalating value and ongoing fascination with this particular collectible.

The Hidden Value: Family Legacy Meets Market Demand

This staggering sale is not merely a transaction; it symbolizes a convergence of sentimental legacy and the burgeoning market for rare collectibles. The Shields family, which consigned the card to Goldin Auctions on the show, has maintained its custody since it was initially pulled from a cigarette pack by Morton Bernstein, their grandfather, over a century ago. Ken Goldin, CEO and founder of Goldin Auctions, described this momentous discovery as “the biggest discovery in the hobby in the past 50 years,” demonstrating the strategic positioning of rare items in an increasingly competitive marketplace. This narrative intertwines the familial emotional investment with the commercial allure, prompting questions about the motivations behind collecting and the emotional weight carried by such objects.

Impact Analysis: Stakeholder Perspectives

| Stakeholder | Before | After |

|---|---|---|

| Collectors | Rare cards are appreciated but often sit within a niche market. | Heightened media exposure increases demand, escalating prices. |

| Goldin Auctions | Standard auction sales with established collectors. | Elevated brand value as a premier destination for high-ticket items. |

| The Shields Family | A sentimental heirloom, valued primarily for emotional reasons. | Transforming sentimental value into significant financial return. |

Collecting Beyond Borders: A Global Ripple Effect

The implications of this sale stretch far beyond the walls of American card shops. In the U.S., the transaction has stirred interests among investors and collectors alike, almost spurring a frenzy as participants seek to capitalize on the booming market. Meanwhile, the UK, Canada, and Australia are feeling the ripple effect, with collectors seeking to secure rare items before values potentially skyrocket further. The intersection of cultural heritage and financial asset brings a new dimension to the trading card marketplace, making collectors in these regions increasingly attentive to the performance of similar items.

Projected Outcomes: What to Watch

- The $1 million club might see new entrants as more undervalued cards come to light; expect market fluctuation.

- Goldin Auctions could pursue innovative marketing strategies to leverage media buzz, attracting a younger demographic.

- International markets may react to this sale by increasing their involvement in American collectibles, reshaping global interest in rare cards.

The recent sale of the Honus Wagner T206 card not only underscores the longevity and familial significance of collectibles but also represents the rising economic winds fueling this dynamic market. Collectors everywhere should remain vigilant, as the tides of value continue to shift in this fascinating intersection of finance, nostalgia, and competition.