Australia’s Housing Crisis Deepens: Why Building More Homes Won’t Solve the Affordability Problem

Australia’s grand vision of solving the housing affordability dilemma through a sweeping National Housing Accord is facing serious headwinds. Despite lofty targets and political will, rising prices, labor shortages, and surging demand are conspiring against progress. In 2025, the median house price jumped again, even as state governments scramble to densify cities and accelerate construction. But supply alone won’t tame runaway costs. Here’s what’s really going on behind the headlines — and why controlling demand must be part of the solution.

The National Housing Accord: Ambitions vs Reality

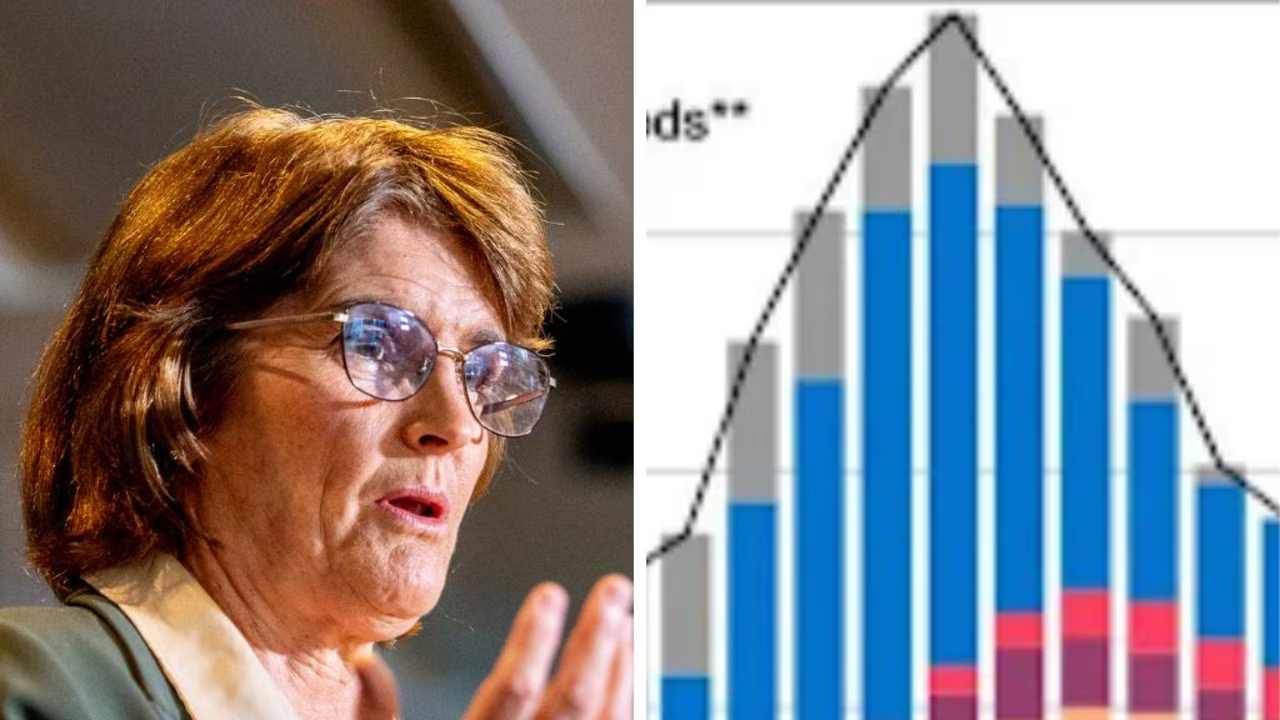

The Accord, launched in October 2022, pledged to deliver 1.2 million homes over five years (240,000 per year starting July 1). But the first year yielded only 170,000 homes — shifting the burden to nearly 260,000 annually for the remaining period. Meanwhile, housing approvals dropped 6 % in August, undermining future supply capacity.

While the Accord emphasizes increasing supply, it explicitly avoids curbing demand — avoiding political battles over negative gearing or capital gains tax. Moreover, it lacks influence over immigration or interest rate decisions, which both play heavy roles in demand dynamics.

Why Median House Prices Are Still Climbing

The core issue is demand outpacing supply — and financial incentives making that imbalance worse.

-

Interest rate cuts: The Reserve Bank of Australia has trimmed interest rates three times in 2025, allowing buyers to stretch further and bid up prices.

-

Deposit scheme pressure: A newly introduced 5 % deposit scheme expands mortgage access, which further fuels demand. Treasury projects it will push prices up by 0.5 % over six years.

-

Population surge: Since the Accord’s inception, 1.4 million net migrants have joined Australia, swelling the population by 1.7 million. Meanwhile, only 512,000 homes were built — a mismatch that translates to a housing shortfall of around 200,000 dwellings, assuming 2.4 people per home.

That mismatch helps explain why the national median house price has jumped by A$127,117 since October 2022 — an average of A$42,000 per year, or a compounded growth rate of 5.5 %. In September 2025 alone, the price climbed by 0.8 %, the steepest monthly increase this year.

Densification Strategies in Key States

States hold authority over planning, and their responses have varied:

| State / Strategy | Key Measure | Notes |

|---|---|---|

| New South Wales | Raise height limits near train stations; guarantee 50 % of pre-sold apartments under A$2 M | If guarantees are triggered, the state may convert units to social housing |

| Victoria (Melbourne) | Urban densification around transit corridors | Emphasizes using existing infrastructure rather than expanding suburbs |

| Other states | Varying engagement | Some are actively reforming planning; others less so |

The NSW model of government-backed pre-sale guarantee is novel. If successful, it could become a national tool — though take-up from other states has been tentative.

The Labor and Productivity Hurdle in Construction

Expanding supply is only possible if the construction sector scales — and that’s where the Accord is most at risk.

-

BuildSkills Australia warns of a 116,700-worker shortfall, about 23.8 % of the workforce needed.

-

To hit housing goals, 139,300 additional residential construction workers must enter the pipeline.

-

Apprenticeship intake has rolled back to pre-pandemic levels, shrinking the future labor pool.

-

Construction productivity has declined ~20 % over the past decade, pushing output back to levels seen nearly 30 years ago.

In short, the industry lacks both the quantity and the efficiency to deliver the volumes required — even if all planning reforms proceed smoothly.

Why Supply-Only Plans Risk Falling Short

Even with concerted efforts to densify cities and boost output, the Accord’s singular focus on supply leaves critical gaps:

-

It does not address speculative demand spurred by tax incentives like negative gearing or capital gains tax concessions.

-

It cannot influence immigration levels, which have been significantly underestimated by Treasury.

-

It assumes the construction sector can rapidly scale — despite evidence of systemic limitations.

-

It relies heavily on states’ willingness to reform urban planning, a trek into contentious political territory.

To genuinely restore housing affordability, Australia may need to combine supply measures with policies that moderate demand — ideally ones that temper speculative buying without stifling genuine homeownership.