Robinhood’s Meteoric Rise: Why HOOD Stock is the Hottest Play on Wall Street Right Now

HOOD Stock Skyrockets After S&P 500 Debut

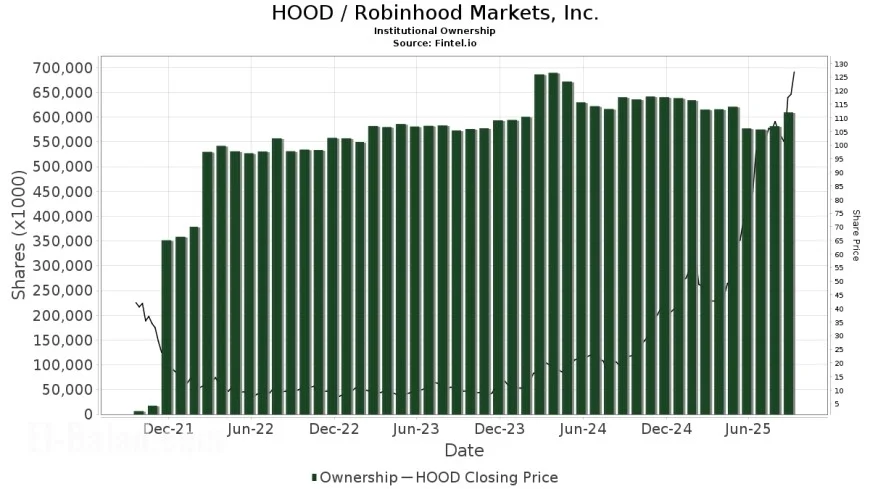

Robinhood’s journey from a scrappy trading app to an S&P 500 member has been nothing short of remarkable. HOOD stock surged more than 7% in pre-market trading as investors reacted to its official inclusion in the index. This move instantly boosted its visibility among institutional funds and index trackers, funneling billions of dollars into the stock.

With a year-to-date gain of over 250%, Robinhood is now the best-performing new entrant to the S&P 500 in 2025. For many, this is proof that the company has managed to turn past challenges into momentum, securing its place among the most influential companies in the U.S. market.

Insider Moves: Vlad Tenev’s $403.9 Million Stock Sale

Even amid the bullish rally, one headline raised eyebrows: CEO Vlad Tenev’s decision to sell about 3.5 million shares of HOOD stock in mid-September, valued at nearly $404 million.

| Detail | Information |

|---|---|

| Shares Sold | ~3.5 million |

| Sale Value | $403.9 million |

| Price Range | $113.10 – $116.48 per share |

| Reason | Taxes tied to performance stock units vesting |

While such large sales often spark speculation about insider sentiment, this move appears to have been tied to tax obligations rather than lack of confidence. Tenev still retains significant ownership, ensuring his stake in Robinhood’s future remains firmly intact.

Robinhood Social: A New Frontier for Trading Communities

At the company’s recent Hood Summit in Las Vegas, Robinhood unveiled Robinhood Social, a platform that blends investing with social networking. The idea is simple but powerful: let users follow each other’s trades, track trending stocks, and learn from both retail traders and institutions.

This concept could transform Robinhood into more than just a brokerage—it may evolve into a community-driven “everything app” for finance. The beta version is expected to launch with limited users next year, and if successful, it could redefine how younger generations engage with markets.

Tokenized Stocks and Global Expansion

Another bold move is Robinhood’s launch of tokenized stocks and ETFs for European customers. This offering allows international investors to access shares of companies like Apple, Nvidia, and Microsoft through blockchain-based tokens.

Benefits of this expansion include:

-

Access for non-U.S. customers to American equities

-

Faster, blockchain-enabled settlement

-

Lower barriers for investors in emerging markets

By offering over 200 tokenized assets, Robinhood positions itself as a bridge between traditional finance and decentralized markets, potentially unlocking a massive global customer base.

Regulatory Fines Still Haunt HOOD Stock

Success hasn’t come without challenges. In March, Robinhood agreed to pay $26 million in fines to FINRA and $3.75 million in customer restitution over compliance failures dating back several years. The infractions included weaknesses in anti-money laundering systems and trade processing disclosures.

Although the settlement resolved older issues, it briefly dragged HOOD stock lower, reminding investors that regulatory oversight will remain a constant companion as the company expands into crypto, tokenization, and social finance.

Strong Operating Metrics Drive Optimism

Despite regulatory bumps, Robinhood’s financials continue to impress:

-

Revenue Q2 2025: $989 million, up 45% year-over-year

-

Net Deposits: $13.8 billion for the quarter

-

Gold Subscribers: 3.5 million, an all-time high

-

Funded Accounts: 26.7 million as of August 2025

These metrics show that Robinhood is successfully monetizing its platform while maintaining a growing user base. Investors see this as evidence that HOOD stock has more room to run, especially if new initiatives like Robinhood Social catch on.

Risks and Rewards: What’s Next for HOOD Stock

As Robinhood enjoys its breakout moment, investors are weighing the risks alongside the opportunities.

Potential Risks:

-

Overvaluation after a 250% surge in 2025

-

Uncertainty around regulatory frameworks for tokenized assets

-

Possible backlash if Robinhood Social doesn’t gain traction

Growth Opportunities:

-

Expansion into international markets via tokenized finance

-

Creating a finance-first social media ecosystem

-

Increased institutional inflows from S&P 500 inclusion

HOOD stock is now at a crossroads. It has the attention of Wall Street, retail traders, and regulators all at once—making its next chapter one of the most closely watched stories in the financial world.