Government Shutdown Jeopardizes IPO Revival

The recent U.S. government shutdown has raised concerns about the revival of the initial public offering (IPO) market. This situation comes at a time when the IPO market is witnessing a resurgence, following a downturn driven by inflation in 2022. So far this year, there have been 163 IPOs, generating approximately $31 billion, according to Renaissance Capital.

Impact of the Government Shutdown on IPOs

The Securities and Exchange Commission (SEC) plays a crucial role in the IPO process, reviewing and approving filings from companies. However, during the current government shutdown, the SEC is operating with a reduced workforce. This limited staffing could lead to significant delays or even a halt in the review and approval processes for IPOs.

Market Confidence at Risk

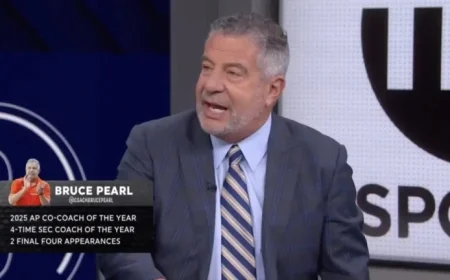

A prolonged shutdown might weaken investor confidence in both U.S. markets and the overall economy. Historically, IPO activity tends to peak through October before experiencing a slowdown during the last two months of the year. Samuel Kerr, head of global equity capital markets at Mergermarket, noted that the government shutdown serves as a reminder of the irregularities currently affecting the market.

Despite various uncertainties throughout 2023, such as fluctuating trade policies, inflation, and labor market concerns, the stock market has continued to hit new highs. Investors are keenly interested in IPOs, particularly in the technology sector, where valuations appear high.

Noteworthy IPOs of 2025

This year has seen several significant IPOs, especially in booming technology areas like cryptocurrency and artificial intelligence. Key IPOs include:

- Circle Internet Group: Launched in June with a valuation of $1.1 billion, it issues USDC and EURC stablecoins. Shares saw an initial price of $31 and have surged to around $152.

- Bullish: The cryptocurrency exchange secured approximately $1.1 billion in August.

- CoreWeave: This cloud-computing firm raised about $1.5 billion during its public debut in March.

- Klarna: The Swedish buy now, pay later company made headlines in September with the year’s largest IPO, raising $1.37 billion. Its shares, priced at $40, are currently trading around $42.

Outlook for the IPO Market

Despite the hurdles posed by the shutdown, experts believe that favorable market conditions still exist. Bill Smith, CEO of Renaissance Capital, emphasized in a statement to investors that the IPO landscape has potential for further activity. The road ahead may be bumpy, but the appetite for IPOs remains strong.