Maduro’s Capture Triggers $400,000 Payout, Highlights Prediction Markets

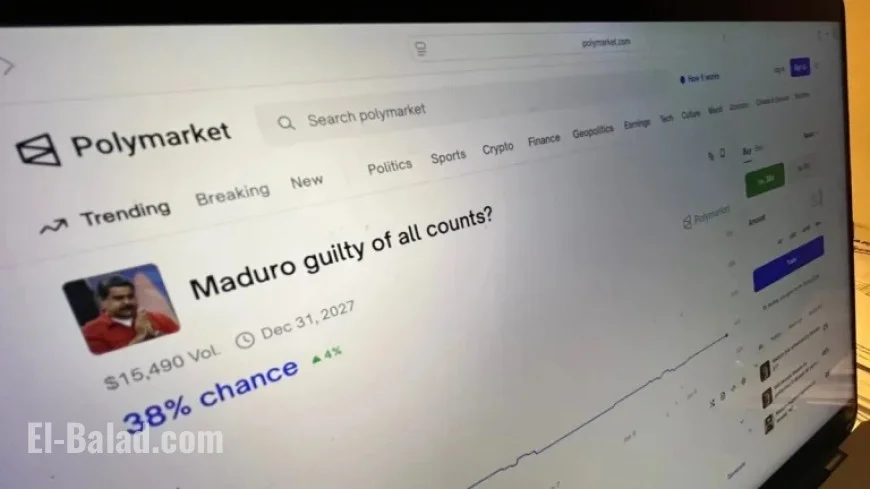

Prediction markets have gained traction in recent years, allowing individuals to speculate on various future events. Recently, a trade involving former Venezuelan President Nicolás Maduro drew significant attention, particularly after an anonymous trader secured over $400,000 by betting on his imminent ousting.

High-Stakes Betting on Maduro’s Downfall

The anonymous trader placed wagers on the platform Polymarket just hours before President Donald Trump announced a nighttime raid that resulted in Maduro’s capture. This timing prompted discussions around the possibility of insider trading, with skeptics questioning whether the trader had prior knowledge of the upcoming events.

The Mechanics of Prediction Markets

Prediction markets allow for varied event contracts, ranging from political elections to pop culture outcomes. Users can invest in what are termed “event contracts,” which reflect their beliefs about the likelihood of specific events occurring. Prices for these contracts fluctuate between $0 and $1, based on collective perceptions, with costs increasing for events seen as likely to happen.

- Contracts can be cashed out early for profit.

- Traders often invest based on personal insights.

- There’s ongoing risk of losing money in these markets.

Legal and Regulatory Framework

In the United States, prediction markets are categorized differently from traditional gambling, leading to questions about transparency and regulation. The Commodity Futures Trading Commission (CFTC) oversees these markets, enabling them to evade certain state-level restrictions present in conventional gambling scenarios.

Polymarket, a major player in this sector, temporarily ceased U.S. operations before receiving approval to relaunch. Competitors like Kalshi, which has been federally regulated, also operate within this space, expanding the range of available event contracts.

Investment Trends and Challenges

Investments in prediction markets have diversified notably. Users place bets on high-profile events, including elections and sports, while also venturing into speculative realms like entertainment and military actions.

Despite their appeal, critics warn of pitfalls associated with these markets, particularly the risks of enabling insider trading and incurring financial losses among uninformed users. As concerns mount, some lawmakers are advocating for stricter regulations to protect participants.

Future of Prediction Markets

With growing interest, the landscape of prediction markets is evolving. Established names in sports betting, such as DraftKings and FanDuel, have launched prediction platforms, signaling a broader acceptance of these betting formats.

As these platforms expand, the legal framework will likely continue to adapt, raising important questions about accountability and transparency in the prediction market ecosystem. Ongoing legislative efforts, including one proposed by Democratic Rep. Ritchie Torres to curb insider trading involving government employees, may shape the future of this burgeoning industry.