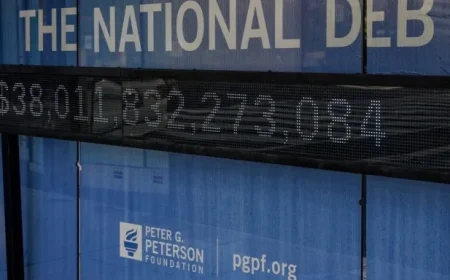

Fed Hawks Waver: Potential Impact on Interest Rates

Recent discussions among Federal Reserve officials indicate a potential shift in their stance regarding interest rates. The minutes from the Federal Open Market Committee (FOMC) meeting held on September 16–17, 2025, highlight concerns about the housing market’s stability.

FOMC Meeting Insights

The recent minutes revealed a growing apprehension among Fed members about a possible collapse in the housing market. This worry could influence the future trajectory of interest rates.

Key Participants

- John Williams: President of the New York Fed, has indicated support for further rate cuts.

- FOMC Members: Varied opinions were expressed regarding the outlook for interest-rate reductions.

Potential Impact on Interest Rates

The wavering stance of Fed officials may signal a shift towards a more accommodative monetary policy. This could lead to additional cuts in interest rates aimed at stabilizing the economy and supporting the housing sector.

Future Considerations

- The Federal Reserve is monitoring the housing market closely.

- Anticipated interest rate cuts may affect borrowing costs.

- The overall economic outlook remains a critical focus for Fed officials.

As these discussions unfold, stakeholders in both the housing market and broader economy will be keenly observing the Federal Reserve’s next moves concerning interest rates. The implications of these decisions could have far-reaching effects on economic growth and consumer confidence.