Is the stock market open on Columbus Day? What traders should expect today

The short answer: Yes, U.S. stock exchanges are open on Columbus Day (also observed as Indigenous Peoples’ Day). The New York Stock Exchange and Nasdaq operate on their regular schedule, with normal open and close times and full electronic trading. That said, the day isn’t “business as usual” across all corners of Wall Street, and smart investors plan around the differences.

Stocks trade as normal, but liquidity can feel holiday-light

Columbus Day is a federal holiday, which closes many government offices and alters staffing across banks and back-office providers. While equity markets are open, trading volumes often run below typical Monday levels, and intraday moves can be choppier as fewer large orders hit the tape. If you’re placing market orders or trading thin names, consider using limit orders and widening your patience for fills.

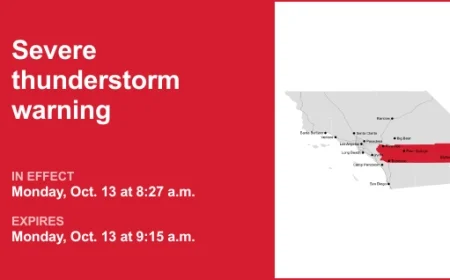

The key exception: U.S. bond markets are closed

Unlike stocks, U.S. Treasury and most corporate bond markets observe Columbus Day. When the bond market takes a holiday, two practical effects spill into equities:

-

Fewer macro cues: With Treasuries offline, there’s no fresh read on yields during the session, which can mute rate-sensitive rotations in banks, utilities, and high-dividend names.

-

Settlement quirks: Some fund flows and pricing models reference bond benchmarks; a bond holiday can slightly adjust NAV timing for fixed-income funds and the plumbing behind certain hedges.

What’s open vs. closed on Columbus Day

| Market/Service | Status | Notes |

|---|---|---|

| NYSE / Nasdaq (U.S. stocks) | Open | Regular hours; watch for lighter volume. |

| Options on U.S. equities/ETFs | Open | Standard expirations proceed; check broker for cutoffs. |

| U.S. bond markets (Treasury, corporates, munis) | Closed | Next session resumes normal trading. |

| CME equity index futures | Open | Globex operates; pit hours may vary by product. |

| Banks & branches | Largely closed | Online transfers post; branch services limited. |

| USPS / regular mail | Closed | Express services may still run. |

How Columbus Day can affect your trades and transfers

-

Order execution: Holiday-thinned order books can lead to wider bid–ask spreads, especially at the open and close. Use price discipline and avoid chasing gaps without confirmation.

-

ETF pricing: Equity ETFs trade normally, but those with heavy fixed-income exposure may show slightly noisier premiums/discounts until bond markets reopen.

-

Cash movement: ACH and wire cutoffs at some institutions can shift; if you’re funding a trade or withdrawing proceeds, confirm same-day timing.

-

Corporate actions & settlements: Standard T+2 equity settlement remains in effect; however, any action referencing bond valuations may roll forward on the next business day.

Strategy notes for active investors

-

Mind the open: Early prints can be jumpy on lighter depth. If you’re scaling into a position, consider staggered entries rather than a single market order.

-

Let price prove itself: On quieter sessions, false breakouts are more common. Wait for closing strength or volume confirmation before declaring a breakout or breakdown “real.”

-

Watch rate-sensitives differently: With Treasuries idle, rate narratives rely on futures and overseas cues. Expect muted correlation between banks and yields intraday.

Why the market stays open on this holiday

U.S. exchanges follow a defined holiday calendar that draws a line between federal holidays (which affect government operations) and market holidays (which reflect trading norms and global coordination). Columbus Day falls into the former, not the latter, so equities trade while the bond market takes a pause. This split helps maintain continuity for global equity investors without over-disrupting the U.S. financial plumbing that does rely on federal calendars.

If you’re asking, “Is the stock market open on Columbus Day?” the answer is yes—stocks and stock options trade on their regular schedule. Expect lighter volume, wider spreads in pockets, and no fresh bond-market signals. Plan orders with a bit more precision, double-check transfer timing, and you’ll navigate the holiday session like a pro.