Walmart Stock Rises Despite Holiday Tariff Threat

Walmart’s stock has seen an uptick, reflecting investor optimism, even amidst concerns related to new tariffs. These tariffs, set to take effect on November 1, threaten to impose a 100% rate on various Chinese imports, which could lead to increased consumer prices.

New Tariff Impact

The planned tariffs come at a challenging time for retailers. Walmart, which sources approximately 60% of its products from China, is particularly vulnerable. Similar pressures are felt by competitors like Amazon, which relies on Chinese goods for up to 70% of its offerings.

Walmart’s Response

- In response to the tariff threat, Walmart has sought to strengthen its supply chain within the U.S.

- The company has also implemented price rollbacks to maintain its reputation for affordability.

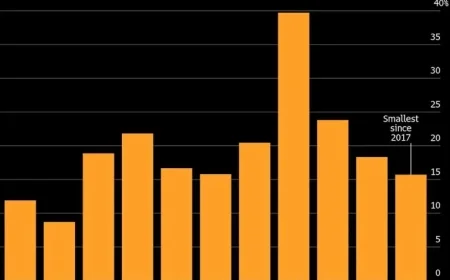

Despite these challenges, Walmart reported second-quarter net sales growth of 4.8% year over year. The increase was primarily driven by significant sales in grocery and health-and-wellness sectors, along with a remarkable 26% rise in e-commerce revenue.

Market Insights

CEO Doug McMillon stated that while consumer sentiment has been shaky, the impact of tariffs has been gradual. This has somewhat muted any drastic changes in consumer behavior. Comparable sales, excluding fuel, rose by 4.6%, bolstered by both increased average transaction size and a higher number of purchases.

Challenges Ahead

Despite a positive outlook in some areas, McMillon warned investors that inflation and uncertainty from tariffs could continue affecting consumers until 2026. This is particularly concerning as the holiday shopping season approaches, a critical time for retail sales.

Stock Analysis

As of now, Walmart’s stock holds a “Strong Buy” consensus based on 29 analyst ratings, with the highest target price set at $129. The average consensus price for WMT currently stands at $114.89, indicating a potential upside of 12.81% from its current trading levels.

In conclusion, while Walmart faces significant hurdles due to impending tariffs, its strong sales performance and strategic actions to enhance supply chains suggest resilience. Investors might keep a close watch on these developments as they consider Walmart stock for their portfolios.