Shares Rise as Dollar Weakens Amid Renewed Fed Rate Cut Speculation

Global financial markets experienced a resurgence on October 15, 2023, as investors responded positively to comments from U.S. Federal Reserve Chair Jerome Powell. His indications of potential rate cuts fueled renewed confidence. Wall Street also benefited from optimistic bank earnings, contributing to a recovery in stock prices.

S&P 500 and European Markets Gain Ground

The Euro STOXX 600 index rose by 0.7%. French stocks saw a notable increase, soaring by 2.4% following strong earnings from luxury goods giant LVMH, whose shares surged by 12%. This performance had a ripple effect, stirring positive sentiment across various sectors.

Fed Chair’s Dovish Tone Sparks Market Optimism

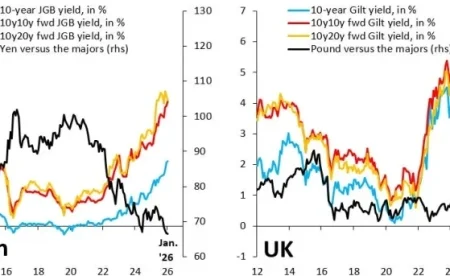

Powell’s comments hinted at a possible halt to the Federal Reserve’s asset reduction strategy. Analysts at Deutsche Bank noted that this dovish tone suggests a potential rate cut by December. Current market expectations price in approximately 48 basis points of rate cuts before the end of the year.

Currency Markets React to Rate Speculation

- The U.S. dollar fell by 0.3% against major currencies.

- The Japanese yen and Australian dollar rebounded after previous declines.

- Wall Street futures showed promising trends, with Nasdaq futures up 0.5% and S&P 500 futures advancing 0.4%.

Impact of U.S.-China Relations on Market Sentiment

Despite the gains, market sentiment remains fragile. Tensions between the U.S. and China escalated due to trade disputes. Recent decisions by President Donald Trump to impose additional tariffs on Chinese goods have heightened uncertainty, contributing to market volatility.

Asia-Pacific Markets and Chinese Economic Data

Asian markets also made considerable gains. The MSCI Asia-Pacific index climbed by 2.1%, with Hong Kong’s market index increasing by 2%. However, deflationary trends in China persisted, with both consumer and producer prices declining in September.

French Bonds Rally Amid Political Developments

In France, Prime Minister Sebastien Lecornu announced a postponement of significant pension reforms until after the 2027 elections. This decision alleviated some political tensions, leading to a rally in French bonds. Ten-year bond yields hit their lowest level since mid-August, dropping to 3.37%.

- French bond yields experience significant decline.

- The euro strengthened slightly, rising by 0.2% to $1.163.

Commodities Market Movements

Gold prices reached a new milestone, surpassing $4,200 per ounce. This spike was buoyed by ongoing geopolitical and economic uncertainties, as well as expectations for potential U.S. rate cuts. Meanwhile, oil prices saw a minor decrease, with Brent crude futures slipping to $62.27 per barrel.

The current market landscape illustrates a complex interplay of factors affecting both investor sentiment and economic expectations. The focus remains on the Federal Reserve’s decisions and their subsequent impact on global financial markets.