Federal Reserve Withdraws Climate Risk Management Guidelines for Financial Agencies

The federal bank regulatory agencies have announced the withdrawal of the Principles for Climate-Related Financial Risk Management for large financial institutions. This decision was made public on October 16, 2025, during a release at 3:00 p.m. EDT.

Background on Climate Risk Management Guidelines

Originally issued in October 2023, the interagency principles aimed at guiding financial institutions in managing climate-related risks. The agencies involved in this initiative included:

- Federal Reserve Board

- Federal Deposit Insurance Corporation (FDIC)

- Office of the Comptroller of the Currency (OCC)

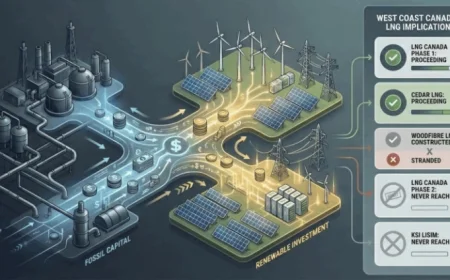

Reason for Withdrawal

The regulatory agencies have determined that separate principles for climate risk management are unnecessary. They assert that their existing safety and soundness standards are sufficient. These standards already require financial institutions to implement effective risk management tailored to their size, complexity, and activities.

Moreover, all institutions under the agencies’ supervision are expected to recognize and manage all material financial risks. This includes emerging risks, such as those related to climate change.

OCC’s Early Withdrawal

Notably, the Office of the Comptroller of the Currency had previously withdrawn its participation in the principles earlier this year. With the recent announcement, the guidelines have been rescinded effective immediately, as indicated in the official notice set to be published in the Federal Register.

Implications for Financial Institutions

This withdrawal signifies a shift in the regulatory approach to climate-related risks. Financial institutions will continue to operate under existing standards without additional guidelines specifically targeting climate risk management.

As institutions adapt, they will still need to remain resilient to a wide array of financial risks while maintaining compliance with the established safety standards set by federal agencies.