BluSmart’s Collapse Highlights Global EV Depreciation Crisis

The global electric vehicle (EV) market is facing a severe depreciation crisis, significantly impacting both individual owners and fleet operators. This issue gained increased visibility following the collapse of BluSmart, India’s first all-electric ride-hailing service, in April 2023. Financial troubles related to fraud caused this company to flood the market with its fleet of thousands of cars, originally valued over $12,000 each, now selling for approximately $3,000.

BluSmart’s Impact on the EV Market

The downfall of BluSmart illustrates a troubling trend in the resale values of electric vehicles. For example, Tesla’s 2023 Model Y has lost 42% of its value in just two years, while a Ford F-150 purchased in the same timeframe depreciated by only 20%. Research indicates that older EV models experience even steeper depreciation than newer versions, a phenomenon attributed to uncertainty around battery lifespan.

Comparative Depreciation Rates

A study from the U.K. found that three-year-old EVs had lost more than half their total value. In contrast, gas vehicles depreciated by 39% during the same period. Boucar Diouf, an EV researcher at Kyung Hee University, noted that in the U.S., EVs could depreciate by as much as 60% within three to five years, while traditional vehicles typically lost less than 50% of their resale value.

Challenges for Fleet Operators

The depreciation crisis poses significant challenges for fleet owners transitioning to electric vehicles. Hertz, a Florida-based rental company that purchased 100,000 Tesla vehicles in 2021, reported a $2.9 billion loss in 2024, primarily due to falling EV values. By late 2024, Hertz lost over $530 per car each month, stemming from high initial costs and long downtime for repairs.

- 30,000 Teslas sold for less than $20,000.

- Current listings include a Model Y for $27,000, while new versions cost around $45,000.

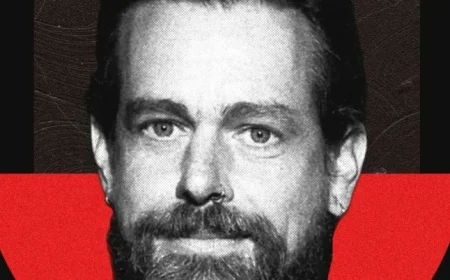

Jack Carlson, CEO of Carvai.ai, emphasized that fleet operators are under immense pressure regarding residual values, as they manage a model of total cost of ownership with precision.

Resale Value Disparities

Despite these challenges, Tesla vehicles retain their value better than many competitors. Brands such as BYD, Nio, and XPeng have lower resale yields. Mariusz Sawula, CEO of autoDNA, highlighted how premium brands generally maintain higher resale values compared to mass-market models.

The depreciation crisis varies globally. EV-friendly markets like China and Norway see stronger resale prices due to their supportive consumer environment. Conversely, North America struggles with its vast distances and charging challenges, making used EVs less appealing.

Consumer Confidence and Future Prospects

Confident consumer sentiment is bolstered by positive regulations and widespread charging infrastructure. For instance, Uber declined to purchase 5,000 used BluSmart vehicles due to concerns about battery performance and warranties. Anirudh Damani from Artha Venture Fund noted that while resale value may seem a minor concern for individuals, it is a critical challenge for fleet operations.

Battery-as-a-service models might provide a solution, allowing fleet operators predictable costs. A McKinsey report anticipates that while only one in five Europeans may consider going electric, fleet companies continue making significant commitments to electrification.

Data Encouraging Market Stability

Emerging data on battery health is fostering greater consumer confidence in used EVs. Research from Recurrent shows that newer batteries deteriorate at a slower rate, with only 1% of cars built after 2016 requiring replacements. This trend is driving the growth of certified pre-owned EV programs and comprehensive state-of-health reports that help consumers make informed choices.

Looking ahead, industry experts forecast that 2026 will be a pivotal year for both market supply and demand adjustments, as manufacturers shift focus toward vehicle longevity.