Austin Voting Guide: What’s on the Ballot

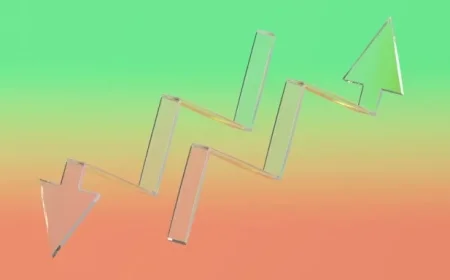

The Austin City Council has officially set a property tax rate for the 2025–26 fiscal year. The new rate is established at $0.574017 for every $100 of property valuation. This represents an increase of 5 cents compared to the voter-approval rate.

Austin Property Tax Increase: Key Details

This tax hike is designed to fund various city programs aimed at improving community services. Key areas impacted include:

- Housing affordability

- Homelessness reduction

- Parks and recreation enhancement

- Public health and safety improvements

- Financial stability of the city

For context, last year’s property tax rate was set at $0.4776 per $100 valuation. The current measure is part of a broader $6.3 billion city budget.

Voter Approval Needed

Because this rate exceeds the state’s limit on tax revenue growth, it necessitates voter approval. If the tax increase passes, homeowners with an average property value of $500,000 can expect an additional cost of approximately $300 annually.

Budget Shortfall and Justifications

The city officials assert that this adjustment is vital to addressing a $33 million budget shortfall. With essential services and programs at stake, the council believes that investing in these areas will benefit the community at large.