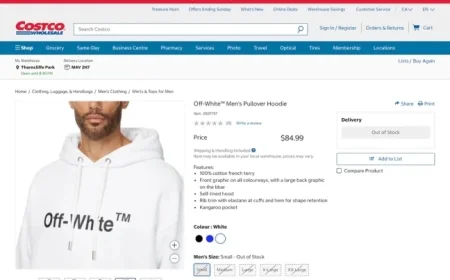

Dow, S&P, Nasdaq Fall; Trump Tariffs, Tech Movers Impact Stocks

Today marks a challenging day for financial markets as both stocks and bonds experience significant declines. The Dow Jones Industrial Average fell by 726 points, translating to a 1.6% decrease. Meanwhile, the S&P 500 dropped by 1.4%, and the Nasdaq composite saw a notable decline of 1.8%.

Market Insights and Factors Influencing Declines

The bond market is struggling as well. The yield on the 10-year Treasury note has risen to 4.3%, a level not witnessed in several months. This increase in yields indicates a downturn in bond prices, as bond values decrease when yields rise.

Impact of Trade Tensions

Uncertainty in the markets is being fueled by President Trump’s recent threats of escalating tariffs on European goods. Should negotiations regarding Greenland not progress satisfactorily, the proposed 200% tariff on French wine and champagne could further strain trade relations. This situation is causing a sell-off of risky assets, with investors moving towards perceived safer investments.

- Decline in Major Stock Indices:

- Dow: Down 726 points (1.6%)

- S&P 500: Down 1.4%

- Nasdaq: Down 1.8%

- Bond Market Trends:

- 10-year Treasury yield at 4.3%

- Declining bond prices due to rising yields

Global Market Reactions

Significant shifts were also noted in international markets, particularly in Japan. The yield on 40-year bonds surpassed 4%, marking a new high since its introduction in 2007. This jump was largely attributed to a lackluster demand during a recent bond auction, signaling investor dissatisfaction with the government’s spending initiatives.

In the U.S., it’s important to note that no major Treasury auctions are scheduled for the remainder of this week, adding another layer of uncertainty to the market landscape.

As these dynamics unfold, market participants are keeping a close watch on developments. The interplay between trade negotiations and interest rates will likely continue to shape investor sentiment and market performance.